A COVID-19 represents one of the greatest ever shocks to our economies and, in consequence, to the business models of financial institutions and the way they do business. Decision-makers must choose between adapting a wait-and-see approach or implementing more proactive strategies to safeguard and, if possible, grow their businesses.

In July of 2017, Andrew Bailey, the chief executive of the UK Financial Conduct Authority (FCA), announced in a speech that after 2021 the FCA would no longer use its power to compel panel banks to submit rate information used to determine the London Interbank Offered Rate (LIBOR). Mr. Bailey encouraged the market to develop robust alternative reference rates to replace LIBOR.

The tax challenges of the digital economy may catch historically non-digital companies by surprise as they “go digital.” Baker McKenzie’s Special Report, Digital Revolution: Transfer Pricing on the Global Tax Battlefield provides insight into digital technology trends non-digital businesses are incorporating and the key tax trends companies must actively navigate including industry sector case studies, transfer pricing considerations, multilateral and unilateral measures, transfer pricing audits and dispute resolution.

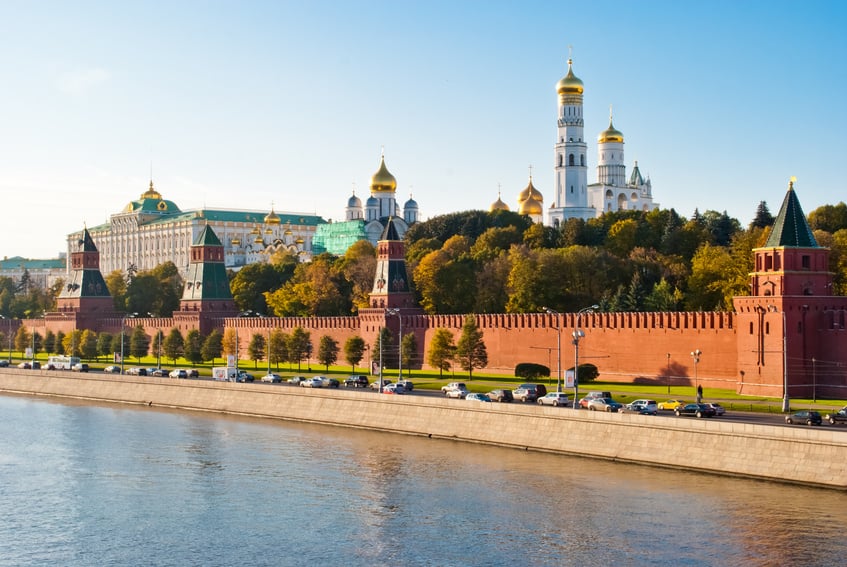

Every year our lawyers produce Doing Business in Russia, a general guide for companies operating in or considering investment into the Russian Federation. The guide presents an overview of the key aspects of the Russian legal system and regulation of business activities in this country.

The Medical Device Regulation (“MDR”) enters into force in the EU. As from that date, the Mutual Recognition Agreement (“MRA”) between Switzerland and the EU no longer applies to trade in medical devices. To avoid a ban on imports, the Swiss Federal Government on 19 May 2021 adopted contingency rules providing for a grace period and clarifying the rules that medical devices need to meet for continued import into Switzerland.

The Brazilian National Health Surveillance Agency (“Anvisa”) published Resolution RDC No. 497/2021 (“RDC 497/2021”) setting forth the new administrative procedure for obtaining the Good Manufacturing Practices Certificate, as well as the Good Distribution and/or Storage Practices Certificate. RDC 497/2021 modifies the general conditions for certification, as provided for in its Chapter II, to facilitate the certification process.

We are pleased to introduce the third part of our trilogy of brief commentaries on Investment Treaty Protection & Covid-19 driven State Intervention. The present Part III is devoted to the defenses, which the host states may use to respond to the potential investors’ claims against the measures.

The Cape Town Convention is designed to protect rights of owners and financiers in movable property, including aircraft and aircraft engines. As a result, lenders, banks, leasing companies and investors would be able to benefit from internationally recognized legal framework and standards for cross-border aircraft leasing and financing transactions. Borrowers and lessees (airlines) potentially should be able to better manage transaction risks, thus reducing costs in respect of Kyrgyz-registered aircraft or aircraft mortgaged by or leased to Kyrgyz entities.

Developing new ESG and climate disclosure requirements (including those relating to supply chain impacts) is one of the SEC’s key priorities, and there have been indications that proposed rule-making on the issue may be imminent. The topic was once again raised by SEC Commissioner Allison Herren Lee this week at the 2021 ESG Disclosure Priorities Event.

The US Customs and Border Protection has issued a Withhold Release Order against a Chinese fishing fleet for suspected use of forced labor in its fishing operations. The WRO instructs CBP personnel at all US ports of entry to detain tuna, swordfish, and other seafood that has been harvested by a fleet of 32 vessels owned and operated by Dalian Ocean Fishing Co., Ltd.