Snapshot: The happenings

Thailand has committed to new global regimes on exchanges of financial information among multiple jurisdictions by joining the Global Forum on Transparency and Exchange of Information for Tax Purposes (Global Forum) in early 2017, and approving in principle the bill to legislate for and implement the two reporting standards late last year. The interjurisdictional information exchanges can be automatic (annually) and on request. The automatic route — incorporating the globally recognized Common Reporting Standard (CRS) — will have more far-reaching impacts on both Thai financial institutions and wealth owners holding assets offshore. For the former, there will be ongoing compliance obligations to periodically furnish customers’ account information to the Revenue Department — much like FATCA (Foreign Account Tax Compliance Act), but with a much larger group of receiving jurisdictions. For the latter, their offshore wealth will likely be brought to light for the Revenue Department to see. Before being fully implemented — perhaps as soon as next year — there is much to be done to prepare for the CRS and its repercussions. We have prepared this newsletter to give you necessary background and our indicative views on the potential impacts on the financial industry in Thailand.

Background: Global perspective

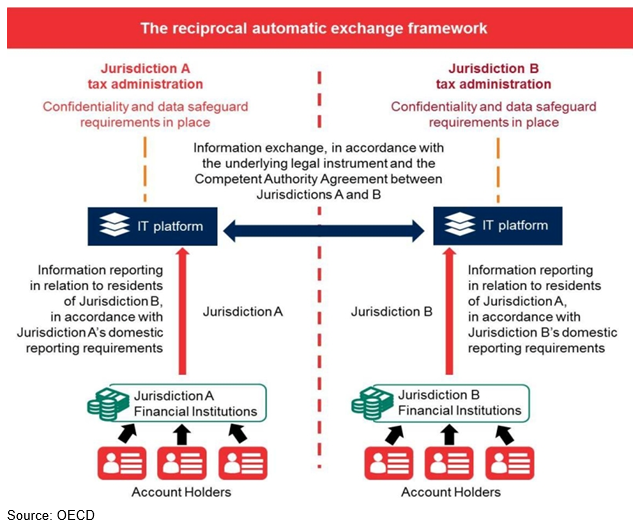

Through various forms of intergovernmental cooperation, jurisdictions around the world have been exploring ways in which they can improve visibility of the offshore financial account information of their tax residents — the United States’ FATCA regime being one such example. Recently, it is envisaged that such visibility is achieved largely through automatic exchanges of information (AEOI), and to a lesser extent, exchange of information on request (EIOR), on a global scale. To help provide a standardized platform for this cooperation, the Organisation for Economic Cooperation and Development (OECD) has developed the CRS, which forms a vital part of the standard for AEOI (AEOI Standard)[1] while the standard for EIOR (EIOR Standard) is separately detailed in documents published by the OECD.[2] The focus of this newsletter is on the AEOI Standard and the CRS, which will likely have far larger impacts on Thai financial institutions and wealth owners than the EIOR Standard. As part of the AEOI Standard, the CRS sets out a minimum standard on the financial account information to be exchanged; the financial institutions required to report (Reporting Financial Institutions); the different types of accounts and taxpayers covered; and the customer due diligence procedures to be followed by the Reporting Financial Institutions. Figure 1 shows the reciprocal automatic exchange framework under such standard. So far more than 100 jurisdictions — including the likes of the British Virgin Islands, the Cayman Islands, Liechtenstein, Luxembourg, the United Kingdom, Hong Kong, Singapore and Switzerland — have committed to the AEOI Standard (incorporating the CRS), either through bilateral treaties or multilateral instruments as legal basis.[3] The first exchanges took place in September 2017.

Background: Thailand perspective

To display its commitment to both AEOI and EOIR, Thailand joined the Global Forum in early 2017, and the Cabinet approved in principle the bill to legislate and implement both the AEOI Standard and EOIR Standard late last year. The bill is generally expected to be enacted later this year. Before Thailand’s first AEOI, the government will need to pass subordinate legislation — incorporating the CRS — to govern the details of the collection and reporting of information and due diligence by Reporting Financial Institutions, and enter into formal AEOI exchange relationships with partner jurisdictions (Partner Jurisdictions) via bilateral treaties and/or multilateral exchange instrument.[4] As regards the EOIR, the first peer review of Thailand’s adoption and implementation of the EOIR Standard is expected to take place in 2020 (the peer review process for the AEOI Standard is still under development), for which it will need to ensure effective exchanges of information on request.

Impacts: Reporting Financial Institutions

While the details of the applicability and requirements to be imposed on Thai Reporting Financial Institutions remain to be seen, we can expect them to at least reflect the principles enshrined in the CRS. Below we summarize two main issues Thai financial institutions may need to consider in anticipation of the AEOI Standard.[5] Please note that this only reflects a minimum standard and if the Thai government chooses to adopt the “wider approach” in its domestic legislative framework, the requirements can be expected to have a wider reach in terms of Reporting Financial Institutions and/or reportable accounts covered.

1. Who will be considered ‘Reporting Financial Institutions’

The CRS defines “Reporting Financial Institutions” to include custodial institutions; depository institutions; investment entities; and specified insurance companies. From the language of the CRS and examples seen in other jurisdictions, it is quite clear that entities like commercial banks, life insurance companies and most securities and derivatives companies in Thailand will be considered Reporting Financial Institutions, but others in the financial industry, such as non-bank financial institutions under FIBA,[6] should take note as well.

2. What needs to be done

In essence, each Reporting Financial Institution will be subject to the due diligence requirements and reporting obligations. They will be required to identify the relevant “reportable accounts” and obtain the information required to be reported for such accounts by applying the relevant due diligence procedures as prescribed under the CRS based on the type of accounts. Generally, the information return needs to contain certain details relating to each reportable account, such as the name; address; jurisdiction of residence; tax identification number; and the account balance (or value) as of the end of the year. This will require the Reporting Financial Institutions to put in place necessary processes and systems to ensure compliance with these requirements.

Impacts: Thai residents

The most obvious impact of AEOI on Thai tax residents[7] is the Revenue Department having better access to details of offshore wealth held in Partner Jurisdictions. Thai wealth owners should therefore recognize that AEOI will ultimately bring to light their offshore financial assets, which should be reviewed to determine whether there are any historical non-compliance issues — particularly, compliance with tax laws and foreign exchange control rules — and how to best address them.[8] Below are examples of potential compliance issues that Thai residents with offshore wealth might be facing with the AEOI in place.

1. Tax laws

Non-compliance with tax laws normally involves undeclared or under-declared taxable income. The penalty could be relatively minor, or could be serious, e.g. back taxes with applicable penalties and surcharges and criminal offenses. Determining if and how a given income from offshore investment needs to be declared and whether there is unpaid tax is a complex undertaking requiring examination of the specifics of each situation. For example, foreign-sourced personal income is only taxable if brought into Thailand within the same year it is earned, while corporate income tax is imposed on worldwide income regardless of whether the income is repatriated to Thailand. Different solutions are appropriate in different circumstances and should be tailored accordingly.

2. Exchange control rules

One notable exchange control rule applicable to Thai residents with offshore assets is the so-called repatriation requirement, although it is rarely enforced due to the lack of information of the authority. With limited exemptions, those who receive income abroad are required to repatriate it into Thailand, and failure to do so in theory carries fines and jail time. With AEOI in place, such historical non-compliance might become known to the Bank of Thailand.

Looking ahead

The introduction of AEOI — and by extension EIOR — will significantly affect the landscape of offshore wealth management for high-net-worth Thai residents, with equally significant repercussions for many players in the Thai financial industry, both in terms of additional compliance burdens and opportunities to help their clients. Given the significant progress on the implementation of AEOI globally, it is only a matter of time before this becomes a new reality for Thai residents and financial institutions. It would be prudent to start assessing one’s situation and make appropriate preparations before that time comes. For Reporting Financial Institutions, the preparations for the new law might mean a preliminary study of the relevant publications from the OECD and lessons from Reporting Financial Institutions in other countries. For wealth owners, these might require an update to their existing private wealth management structure, which may involve alternatives under foreign or domestic laws (e.g. Thai private trusts, which are expected to be legislated for later this year). We will keep you updated should there be any developments.

[1] See OECD (2017), Standard for Automatic Exchange of Financial Account Information in Tax Matters, Second Edition, OECD Publishing, Paris. http://dx.doi.org/10.1787/9789264267992-en.

[2] See the 2002 Model Agreement on Exchange of Information on Tax Matters and its Commentary and Article 26 of the Model Tax Convention on Income and on Capital.

[3] OECD (2018), Activated Exchange Relationships for CRS Information, OECD Publishing, Paris, available at http://www.oecd.org/tax/automatic-exchange/international-framework-for-the-crs/exchange-relationships/#d.en.345426.

[4] OECD (2018), Standard for Automatic Exchange of Financial Account Information in Tax Matters: Implementation Handbook, OECD Publishing, Paris.

[5] See OECD (2017), Standard for Automatic Exchange of Financial Account Information in Tax Matters, Second Edition, OECD Publishing, Paris. http://dx.doi.org/10.1787/9789264267992-en.

[6] The Financial Institutions Businesses Act B.E. 2551 (2008) (as amended).

[7] We only focus on Thai tax residents with offshore wealth as account holders here in this newsletter. While the AEOI will certainly have an effect on tax residents of Partner Jurisdictions with reportable accounts in Thailand, this latter aspect is of less relevance here.

[8] In some jurisdictions, for example, tax amnesty programs or voluntary disclosure schemes were offered as part of the implementation of the AEOI.