In a move that the Monetary Authority of Singapore (MAS) describes as new phase in the country’s banking system, MAS announced it intends to issue up to five new bank licences to digital players1. This will be in addition to any internet-only bank services offered by local banking groups.

The five new bank licences will comprise two digital full bank licences and three digital wholesale bank licences, and application (targeted for August 2019) will be open to players of non-bank parentage. In addition to their technology and e-commerce business, the successful applicants will be licensed to provide:

- savings accounts;

- loans; and

- simple credit and investment products.

To ensure this measure to liberalise Singapore’s banking sector does not negatively affect the country’s long-term financial system stability, the following will be part of MAS’s new digital bank regime:

- prudent baseline requirements on track record and sustainability of business models;

- safeguards to protect depositors, mitigate the risk of untested business models, and minimise costs to the financial system in the event of a failure; and

- business requirements for licensees to ensure a level playing field for both the new digital banks and the incumbents.

MAS has released frameworks containing the eligibility criteria, requirements and safeguards, for digital full banks2 and digital wholesale banks3.

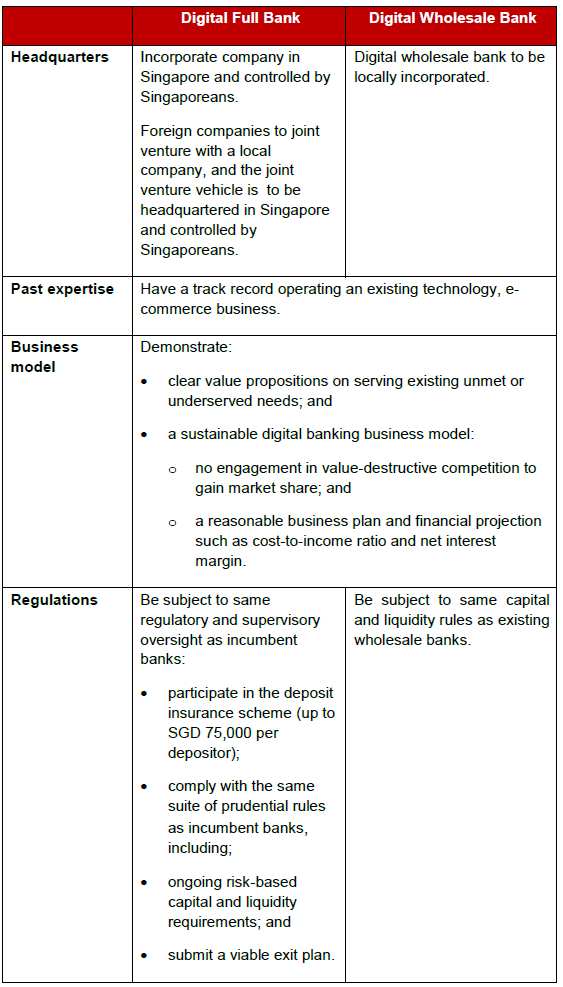

We summarise below both the general eligibility criteria for both types of digital banks below, as well as the permissible activities and business restrictions specific to each class of digital bank.

General eligibility criteria

Applicants for digital full bank licences and digital wholesale bank licences must meet the following criteria and comply with the following regulations:

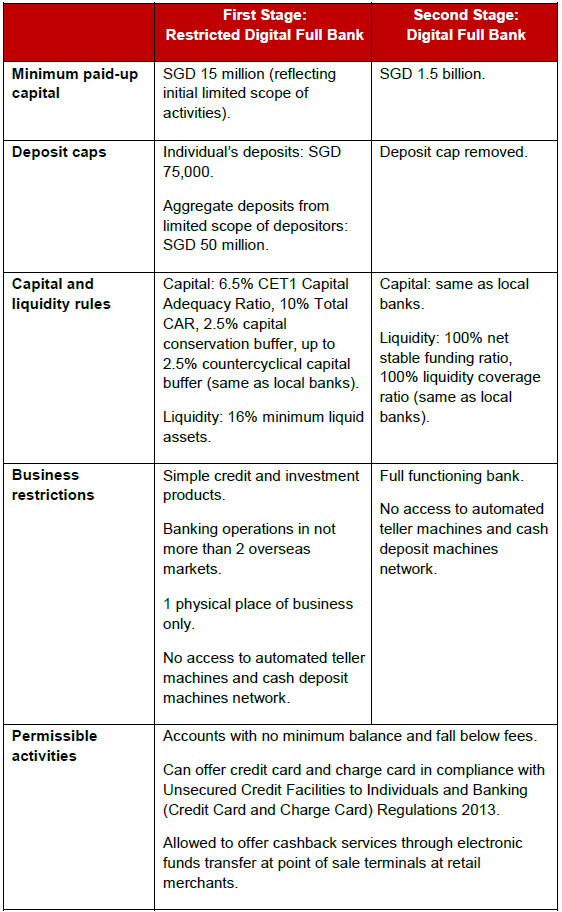

Digital full bank framework

MAS intends to apply a two-stage process for digital full banks with permissible activities and business restrictions applicable to each stage, summarised below.

MAS will not prescribe a time period within which graduation to a digital full bank must be achieved.

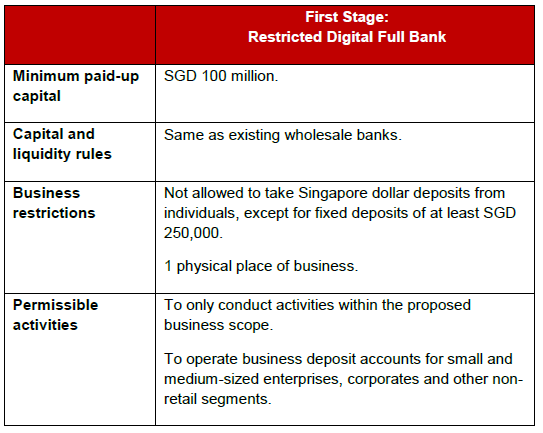

Digital wholesale bank framework

The permissible activities and business restrictions applicable to digital wholesale banks are summarised below:

Timeline

MAS expects to invite applications in August 2019, and will provide more details on the eligibility and admission criteria at that time.

The digital wholesale banks will be introduced as a pilot, and MAS will review whether to grant more such licences in the future.

If you have any questions on the new digital bank frameworks or application process, please do not hesitate to contact us.

1 see: https://www.mas.gov.sg/news/media-releases/2019/mas-to-issue-up-to-five-digital-bank-licences

2 see: https://www.mas.gov.sg/-/media/Annex-A-Digital-Full-Bank-Framework.pdf

3 see: https://www.mas.gov.sg/-/media/Annex-B-Digital-Wholesale-Bank-Framework.pdf