In brief

The Ministry of Finance of the Republic of Indonesia (MOF) recently issued MOF Regulation No. 134/PMK.010/2020 on Government Borne Import Duties for the Importation of Goods and Materials to Produce Goods and/or Services in Certain Industries that are Affected by the COVID-19 Pandemic (MOF Regulation 134). This regulation was enacted to maintain the availability of raw materials during the COVID-19 outbreak and is only effective from 22 September until 31 December 2020.

Through MOF Regulation 134, the government took the initiative to bear import duties of certain goods and materials for 33 industrial sectors that are under the supervision of four directors general (i.e., agro-industries; small and medium sized industries; chemical, pharmacy and textile industries; and electronic, transportation equipment, machinery and metal industries). The types and HS Codes of goods and materials that may enjoy the facility are listed under the annex of MOF Regulation 134, with the state budget for each industrial sector ranging from approximately IDR 15 million to IDR 150 billion.

Up until 31 December 2020, Government Borne Import Duties (Bea Masuk Ditanggung Pemerintah/BM DTP) may be applied for the following activities that meet the requirements:

- importation of certain goods and materials by certain manufacturing companies

- release of goods and materials that come from outside the Indonesian customs area to another region inside the Indonesian customs area from a bonded logistics center, bonded warehouse or bonded zone for the purpose of industrial companies

Requirements

A. Requirements with regard to imported industrial goods and materials

In addition to the basic requirement that the imported goods and materials should be listed under the annex of MOF Regulation 134, there are additional requirements that should be fulfilled.

- To receive BM DTP, the imported goods and materials must meet one of the following requirements:

- The goods and materials were not produced in Indonesia.

- The goods and materials were produced in Indonesia but did not meet the required specifications.

- The goods and materials were produced in Indonesia but did not meet the industrial requirements in accordance with the ministry’s and institution’s recommendation.

- Further, imported goods and materials should be exempted from receiving BM DTP if:

- The goods and materials are subject to 0% import duty.

- The goods and materials are subject to 0% import duty based on an international agreement or treaty.

- The goods and materials are subject to import duties related with anti-dumping, temporary anti-dumping, security measures, temporary security measures, countervailing duties and retaliation.

- The goods and materials are intended to be stored in bonded storage.

B. Requirements for industrial companies to fulfill

- Industrial companies applying for the BM DTP should fulfill the following conditions:

- The industrial company over the past year has never incorrectly notified the quantity and/or types of goods in the import declaration in receiving BM DTP, which led to insufficient payment of import duties.

- The industrial company does not have any outstanding payment for import duties, excise and/or taxes that are due with regard to import.

- Industrial companies must prepare the following documents/information to apply for the BM DTP:

- company’s identity

- list of the relevant goods and materials along with the details set out under Article 8 paragraph 9 of MOF Regulation 134

- invoice and packing list

- a recommendation letter from the ministry, which can be obtained through INSW by submitting documents a, b and c above

Specifically for goods and materials that are released from a bonded warehouse or bonded zone, the industrial company must submit the following information of the bonded warehouse business or bonded zone business to apply for the BM DTP:

- company’s identity

- taxpayer identification number

- ministry decree number on the warehouse and bonded zone business license

- name and position of the relevant person in charge

Procedure to apply for the BM DTP

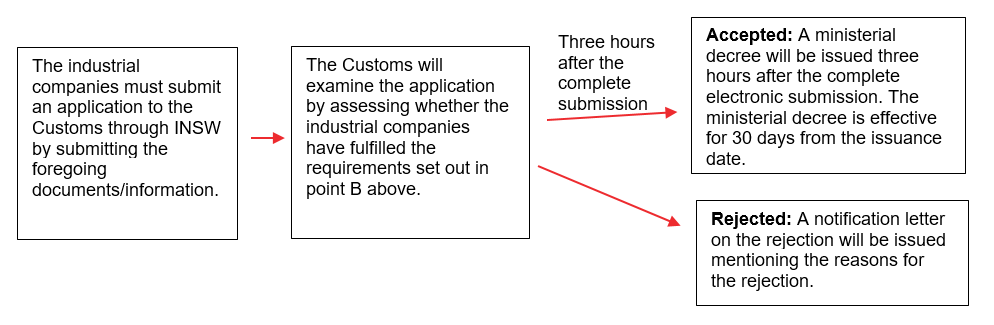

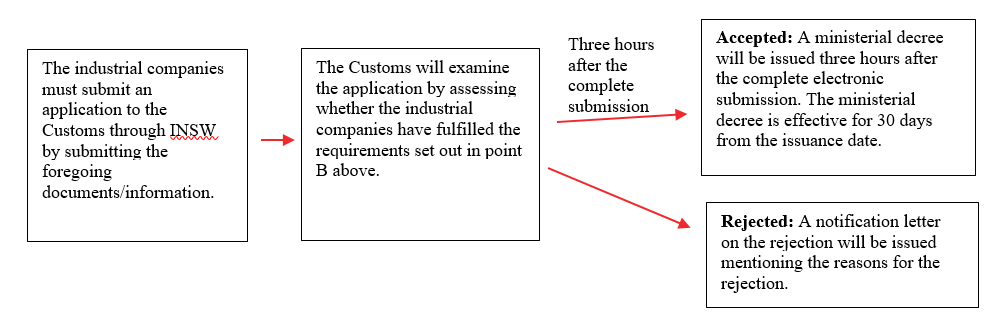

The procedure to electronically acquire BM DTP through INSW based on MOF Regulation 134 is as follows:

- The industrial companies must submit an application to Customs through INSW by submitting the foregoing documents/information.

- Customs will examine the application by assessing whether the industrial companies have fulfilled the requirements set out in point B above.

- Three hours after the complete submission:

- Accepted: A ministerial decree will be issued three hours after the complete electronic submission. The ministerial decree is effective for 30 days from the issuance date.

- Rejected: A notification letter on the rejection will be issued mentioning the reasons for the rejection.

The issuance of the ministerial decree does not automatically grant the BM DTP. When importing the relevant goods and materials, the manufacturing company must mention the details of the ministerial decree in the import declaration. The government officials will then examine the declaration before granting the BM DTP.

Actions to consider

Industries that are eligible to receive BM DTP may want to consider immediately applying for the facility because MOF Regulation 134 only applies for the remaining part of 2020. Industries should also note that the granting of BM DTP may also rely on the sufficiency of the state budget. Therefore, while MOF Regulation 134 aims to positively affect the 33 industries, we would need to see how it is implemented in practice.