With LIBOR set to be discontinued on a permanent basis, corporate service providers and corporate trustees must transition to alternative rates before the phase-out begins at the end of 2021. This is a challenging undertaking, particularly in relation to “tough legacy” transactions, with thousands of contracts requiring re-papering. This requires the review and redrafting of multiple documents, a process which is both time intensive and expensive.

Bearing this challenge in mind, we needed to streamline the re-papering process for our clients. We needed to create an end-to-end solution that provides the right balance of legal expertise, legal project management and technology.

Our Reinvent Approach

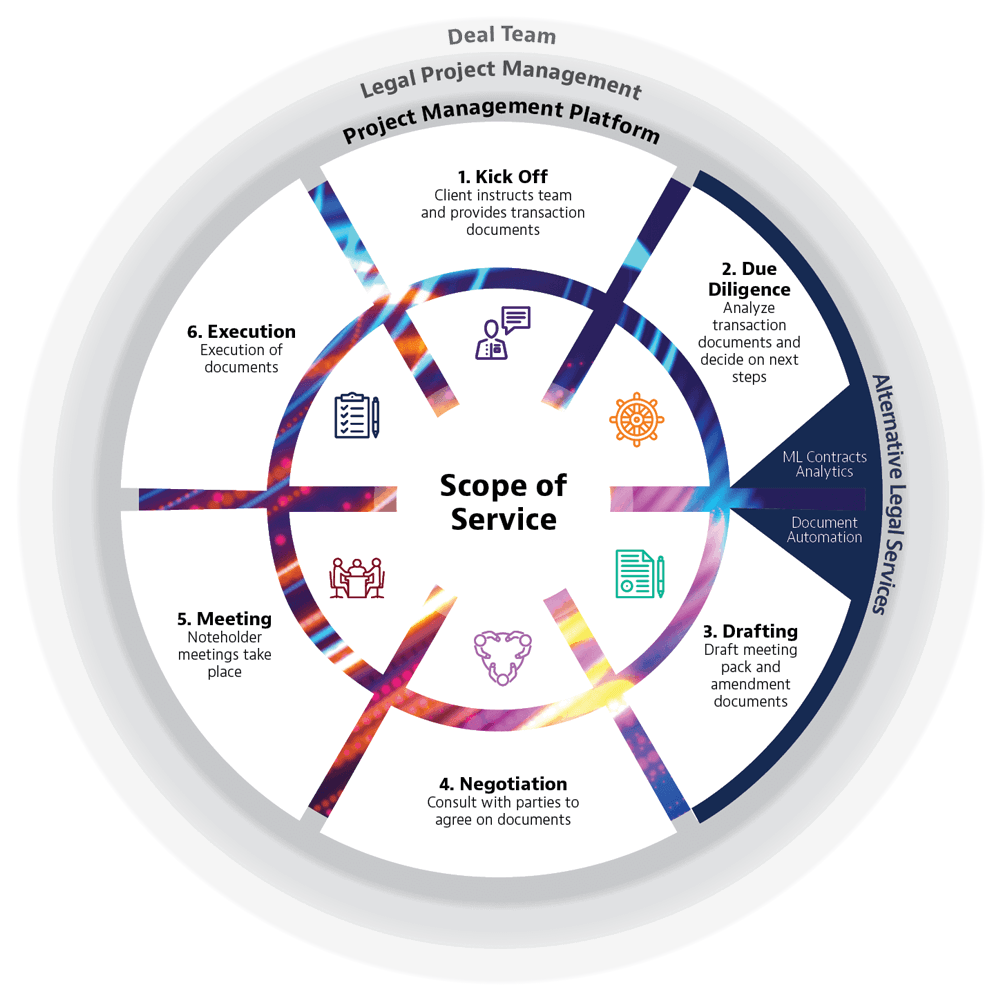

We decided to reinvent how we approached this challenge. We were able to do this through the Reinvent Fellows program, an innovation initiative whereby lawyers are given time from their fee-earning work to change how the Firm works or address a material client problem. This was led by Sarah Porter, who was assisted by the Firm’s service design team. Design thinking methodology was used to provide a deeper understanding of the legal and practical challenges LIBOR transition creates. Client and internal pain points were mapped out, allowing us to identify opportunities for efficiency and ultimately design a better process. As a result, six distinct phases were identified (Kick-off, Due Diligence, Drafting, Negotiation, Meeting and Execution), with each phase taken in turn to ascertain where the greatest efficiencies could be made. The Firm’s people, process and technology were then mobilized and integrated to deliver a solution.

The Solution

Reinvent LIBOR is a streamlined, end-to-end re-papering solution:

- People: The solution connects our structured finance lawyers with our legal project management, alternative legal service and technology teams. This collaboration is much more than the sum of its parts.

- Process: Each stage of the process is carried out by those with the best skillset to do so. Our legal project management team coordinates the process to ensure efficient implementation of this technology as well as a standardized approach to each project. Lawyers based in our centre of excellence in Belfast provide dedicated support to assist in achieving greater efficiency and economies of scale. Our structured finance lawyers are then able to focus on addressing the complex and challenging issues that arise from LIBOR transition and deliver a dedicated and high quality solution.

- Technology: A tailored Baker McKenzie Online site (the Firm’s project management platform) is used to connect our lawyers, clients and legal project managers to enable better collaboration throughout the entirety of the project. eBrevia (our chosen machine learning contract analytics platform) is utilized to assist in the due diligence phase, which is then interfaced with Contract Express (the Firm’s document automation platform) to automate the creation of relevant documentation.

The Result

The impact for corporate service provider clients has been significant. The integration of people, process and technology provides an accurate, efficient solution that can be flexed and customized. Despite the challenges of transition, Reinvent LIBOR offers a tried-and-tested pathway that minimizes risk, while offering cost certainty and access to a dedicated team of specialists when it matters.

For more information about Reinvent LIBOR, please contact Sarah Porter.