In brief

On 13 July 2021, the EU Council of Ministers approved the national recovery and resilience plans (RRPs) of 12 Member States. This means that Austria, Belgium, Denmark, France, Germany, Greece, Italy, Latvia, Luxembourg, Portugal, Slovakia and Spain are now able to tap into the EU recovery and resilience funding. This will allow them to start spending the money on projects and reforms for national economic recovery and resilience, as well as the green transition and digital transformation.

In more detail

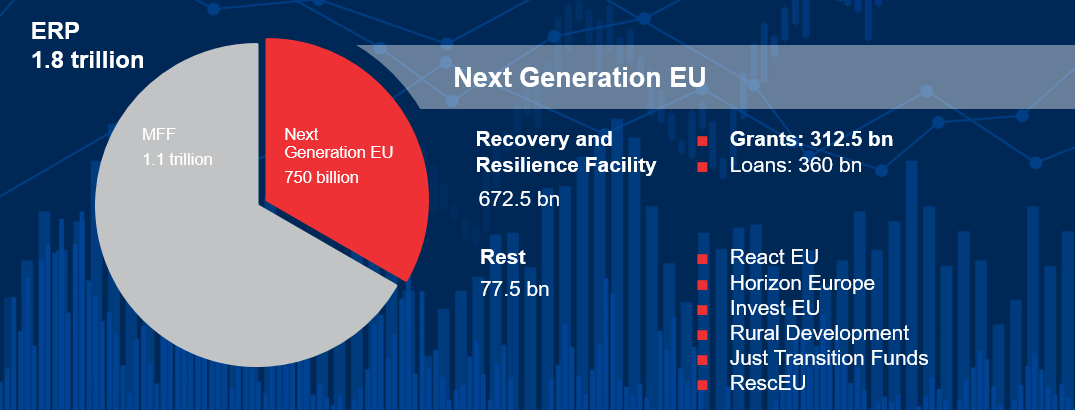

On 21 July 2020, the European Commission announced the EUR 1.8 trillion European Recovery Plan (ERP) to boost economic resilience and recovery across Europe in the wake of the devastating effects of the COVID-19 pandemic. The ERP includes the Recovery and Resilience Facility (RRF), which makes EUR 312.5 billion and EUR 360 billion in grants and loans, respectively, available to the 27 EU Member States to support reforms and investments to make European economies and societies more sustainable, innovative, resilient and to promote the green transition and digital transformation.

Access to RRF funding is subject to Member States having their RRPs submitted to and endorsed by the European Commission for approval by the EU Council of Ministers.

The six largest recipient countries of the RFF grants and loans are as follows:

- Italy with EUR 191.5 billion (EUR 68.9 billion and EUR 122.6 billion in grants and loans, respectively)

- Spain with EUR 69.5 billion (grants only)

- France with EUR 40.9 billion (grants only)

- Poland with EUR 36 billion (EUR 23.9 billion and EUR 12.1 billion in grants and loans, respectively)

- Greece with EUR 30.5 billion (EUR 17.8 billion and EUR 12.7 billion in grants and loans, respectively)

- Germany with EUR 25.6 billion (grants only)

With the exception of Poland, these are all included in the first 12 Member States who had their national RRPs approved on 13 July 2021.1 Now, each of these 12 Member States is ready to conclude their financing agreement with the European Commission. Under these agreements, they will receive 13% of the total volume of grant funding, as per their national RRP, upfront. Additional disbursements from the RRF are based on the implementation of their RRP taking into account the milestones and targets set out in the RRP. Member States spending under the RRP will take place primarily in the following six focus areas:

- green transition

- digital transformation

- economic cohesion, productivity and competitiveness

- social and territorial cohesion

- health, economic, social and institutional resilience

- policies for the next generation

The RRF requires that national RRPs allocate at least 37% of the total expenditure to investments and reforms that support climate objectives and at least 20% of expenditure to digital transition. The remainder can be allocated to the other four focus areas.

In fact, Member States’ RRPs are more heavily geared toward the green transition with, for instance, Austria, Denmark and Luxembourg devoting around 60% of their RRP spending to the green transition. Germany’s RRP seems to be the exception, focusing more heavily on the digital transition.

What does that mean for businesses?

RRP funding will start to be disbursed shortly. You should ensure that you have assessed whether in the Member States relevant to your operations the national RRP includes opportunities for projects in your pipeline, e.g., relating to strengthening the supply chain and reducing CO2 so that you do not miss free public co-funding.

Your projects may be eligible for such co-funding if: (i) they relate to investments that will be completed by the end of August 2026; and (ii) they fall squarely within the RRF parameters of a Member State’s RRP. It is expected that the RRPs of the remaining Member States will meet with European Commission endorsement and European Council approval later this year.

Green transition projects under national RRPs include energy renovation of (private and/or public) buildings, investments in related research, development and innovation (R&D&I) in relation to green/alternative technologies (including hydrogen), investments into low-emission public transport, etc.

Digital transition projects include investments in related R&D&I, the deployment of new digital technologies, the digitalization of public administration and/or businesses, cybersecurity, electronic identity, the expansion of ultrafast broadband networks and 5G connectivity, the digitalization of education, etc.

Most of this funding will be made available following funding competitions to which public procurement rules may apply. In addition, any RRP funding remains subject to compliance with the EU’s state aid rules. We will be happy to assist with related compliance questions and issues to ensure that any RRP funding that you access is and remains yours to keep.

For more “Insights,” you may visit Baker McKenzie’s Antitrust & Competition page.

For more information on the RRF, see useful Q&As on the European Commission’s website here (which includes links to other information on the RRF).

1 The additional seven who had their RRPs approved are Austria, Belgium, Denmark, Latvia, Luxembourg, Portugal and Slovakia.