In collaboration with the Monetary Authority of Singapore (MAS), Bank of Thailand (BOT), bank participants and operators, we are pleased to present this white paper on the project to link Singapore’s PayNow and Thailand’s PromptPay fast payment systems (PPPN Linkage).

Glean highlights of the technical, operational, commercial and governance issues addressed by the participants in the PPPN linkage, which include:

- anti-money laundering

- sanctions screening

- data usage

- redundancy practices

This paper seeks to promote a better understanding of the key considerations for establishing cross-border linkages between two or more national fast payment systems, thereby paving the way for national authorities to pursue more of these linkages in the future.

While supporting the coordination of the project, Baker McKenzie’s Singapore and Thailand offices advised on and drafted the documentation for the legal and governance framework. This being a novel and unprecedented cross-border initiative, for which there were no direct precedents, careful consideration of the legal and regulatory issues was required and novel solutions were necessary, such as a unique governance model. This needed to be scalable for new participants and new jurisdictions to join in the future and, by being based on common principles, capable of being mirrored and adapted to similar arrangements with other countries.

About the PPPN Linkage White Paper

This white paper outlines how this first-of-its-kind linkage was conceived and developed by the MAS and the BOT, working closely with industry partners in both countries. The PPPN linkage represents a first step toward a broader vision of unlocking the multilateral connectivity of countries’ fast payment systems. This will help establish a comprehensive cross-border transfer network to enable customers in participating countries to make fast and secure cross-border transfers via their mobile phones or internet devices at a competitive cost.

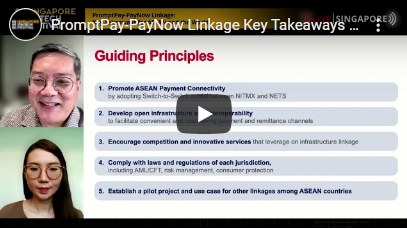

Related Link: Baker McKenzie key takeaways from the PPPN Linkage at the Singapore FinTech Festival 2021

At the 2021 Singapore FinTech Festival Showcase Stage, Ken Chia and Kullarat Phongsathaporn provide an overview of the PayNow-PromptPay/PromptPay-PayNow Linkage and its impact on the ASEAN e-payment market. They also share their insights and key takeaways from co-leading the project. Ken is a principal from Baker McKenzie Wong & Leow and Kullarat is a partner from Baker McKenzie Thailand.