In brief

On 20 March 2023, the FCA published a Dear CEO letter to benchmark administrators setting out the findings of its preliminary review into ESG benchmarks. The review covered: (i) the quality of disclosures made by a sample of UK benchmark administrators; and (ii) the robustness and reliability of ESG benchmarks themselves.

The FCA’s key finding was that the overall quality of ESG-related disclosures made by benchmark administrators is currently “poor”. In particular, the FCA considered that certain administrators have adopted the following unsatisfactory practices:

- Providing insufficient detail on the ESG factors considered in benchmark methodologies.

- Not ensuring that the underlying methodologies for ESG data and ratings products used in benchmarks are accessible, clearly presented and explained to users.

- Not fully implementing ESG disclosure requirements as set out in the UK version of the Low Carbon Benchmarks Regulation.

- Failing to implement their ESG benchmarks’ methodologies correctly (e.g., by using outdated data and ratings or failing to apply ESG exclusion criteria).

Contents

Although these findings will be of direct relevance to UK benchmark administrators, they will also be of key interest to asset managers and other firms that incorporate ESG benchmarks into their investment decisions in some way, or that seek to measure performance of financial products in reliance on ESG benchmarks.

How do ESG benchmarks work?

ESG benchmarks may be used to determine the performance and the ESG credentials of various investment products (e.g., investment funds). Benchmark administrators are responsible for implementing the methodologies and calculations that define the ESG performance of the relevant products. Various market participants rely on such benchmarks to make investment decisions and the FCA is therefore keen to ensure accuracy in this space for investors.

Benchmark administrators provide indices that are used in:

- Financial instruments traded on trading venues or via systematic internalisers in the UK

- Mortgage or consumer credit contracts

- Investment funds

Often, practitioners find it difficult to discern the difference between an index and a benchmark. Both are defined in Article 3 of the retained EU law version of the Benchmarks Regulation (UK BMR). An index is a broader term which is used to describe any figure that is published and regularly determined. An index has the ability to become a benchmark when a figure is used to determine the financial return or value of a financial instrument. Benchmarks are best understood as analytical tools that help track the return of an investment fund, define asset allocation or compute performance fees. T

hus, the role of a benchmark administrator is to use benchmarks as an analytical tool to demonstrate the ESG credentials of distinct investment products.

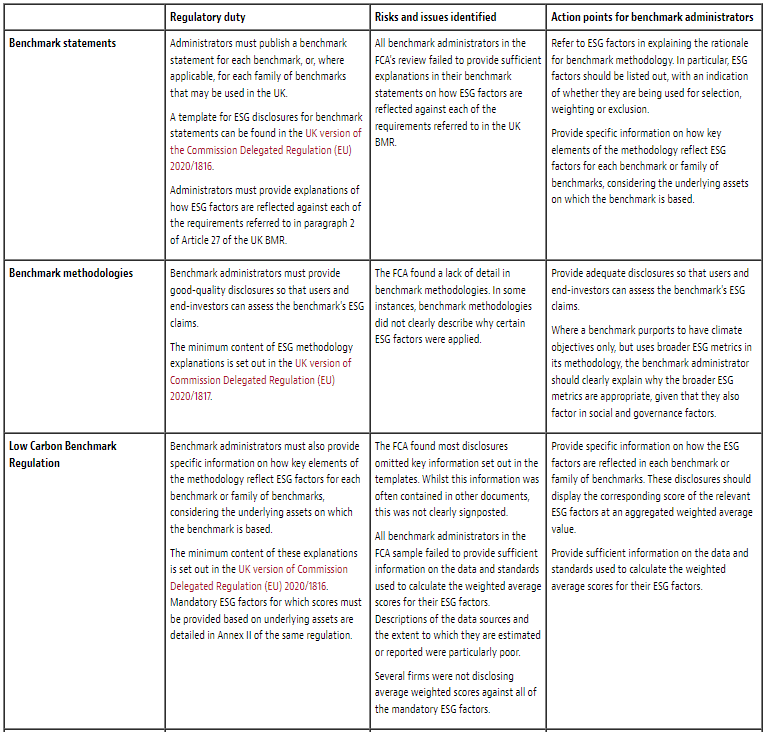

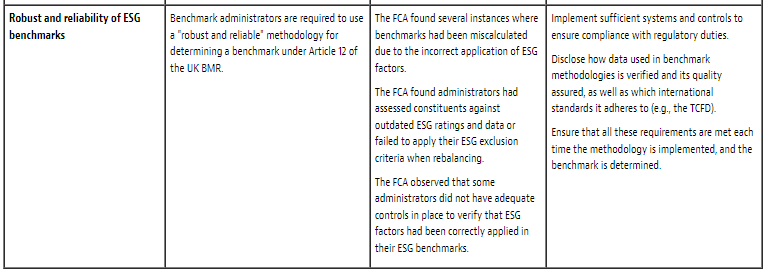

Risks, issues and action points for administrators

The Dear CEO Letter sets out the FCA’s assessment of the risks observed and the issues identified in the preliminary review, along with action points for benchmark administrators to take in response to the concerns raised:

Next steps

Benchmark administrators, and their senior leadership, should carefully consider the risks, issues and action points identified by the FCA, and have appropriate strategies to address them. The FCA expects administrators to be prepared to explain these strategies at the regulator’s request. Given the importance of ESG benchmarks and initial findings from the review, the FCA plans to holistically consider the risks of harm related to ESG benchmarks across the value chain.

There are a number of other recent developments and initiatives relating to ESG regulation and data. The FCA supports the regulation of ESG ratings and is working with the government, which is expected to consult shortly on whether and how to extend the FCA’s perimeter to include ESG ratings providers. However, adoption of the legislative measures necessary to achieve this will take some time – to that end, the FCA has formed a working group to develop a voluntary code of conduct for ESG data and ratings providers (for further detail, see our related client alert).