In brief

Effective on 25 March 2024, the Stock Exchange of Thailand (“SET”) updated the requirements for acquisition, by a listed company or its subsidiaries, of the assets of a non-listed company (“Backdoor Listing”), and the requirements for the listing of securities of a company formed by amalgamation between a listed company and non-listed company (“Relisting”). These revisions aim to strengthen the consideration process and the required qualifications of companies proceeding with Backdoor Listing and Relisting, in order to maintain the same standard comparable to a new listing.

In more detail

A. Backdoor Listing

(1) A financial advisor is required in preparing a Backdoor Listing Application

Previously, a listed company proceeding with Backdoor Listing could, by itself, prepare a relisting application which is required to be submitted to the SET for approval (“Backdoor Listing Application”). The amendment adds the requirement that a Backdoor Listing Application must be jointly prepared by a financial advisor (FA) whose name is on the list approved by the Office of the Securities and Exchange Commission (“Office of the SEC”).

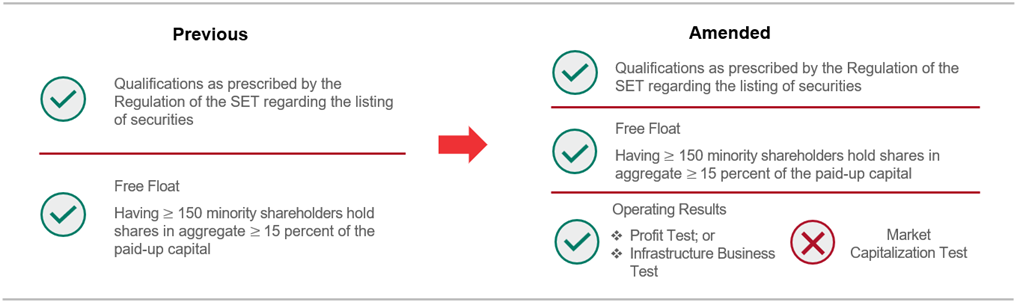

(2) A market capitalization test cannot be used

Previously, after an acquisition of assets categorized as Backdoor Listing, the listed company had to possess the qualifications prescribed in the SET regulation regarding the listing of securities[1] (including either a profit test, infrastructure business test, or market capitalization test), except for the qualification regarding distribution of shareholding (“Free Float”) in accordance with the rules regarding the status maintenance of listed companies. The amendment provides that a listed company undergoing Backdoor Listing must have the qualifications regarding operating results in accordance with the profit test or infrastructure business test only; the market capitalization test cannot be used.

(3) The SET may involve the Office of the SEC in reviewing a Backdoor Listing Application

Previously, the SET had sole discretion to approve a Backdoor Listing, without the Office of the SEC’s approval. The amendment provides that when the SET considers a Backdoor Listing Application for approval, it may submit the application to the Office of the SEC for joint consideration. Both the SET and the Office of the SEC have the authority to consider the qualifications of the listed company as an applicant, its financial advisor and auditor, especially the internal audit and conflict-of-interest matters.

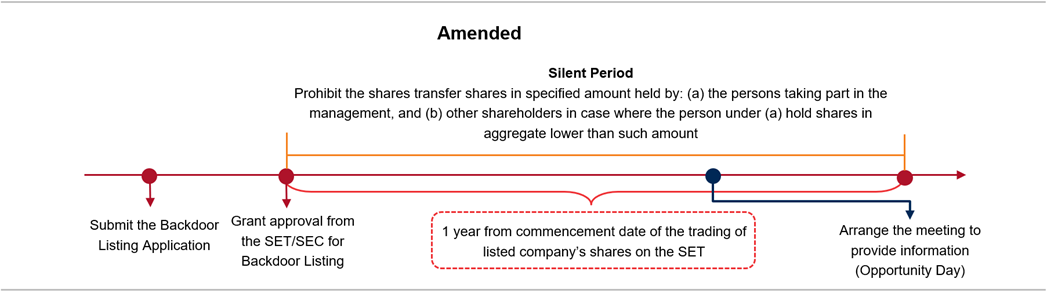

Additional requirements after receiving Backdoor Listing approval

The amendment adds two new post-approval requirements that the listed company must proceed with after receiving Backdoor Listing approval:

(4) Silent period: To prohibit any share transfer of the listed company – in aggregate of 55 percent of the paid-up capital after submitting the Backdoor Listing Application – of shares held by: (a) the persons taking part in the management of the non-listed company or of the previous owner of the assets acquired by the listed company; and (b) other shareholders if the person described under item (a) holds shares, in aggregate, lower than that amount, within one year from the commencement date of trading of the listed company’s shares on the SET.

(5) Arrange a meeting to provide information (an “Opportunity Day”) regarding its business and operating results, for shareholders, investors, and relevant parties, at least once within one year from the commencement date of trading of the listed company’s shares on the SET.

(6) Warning to investors regarding entry into a Backdoor Listing transaction

The SET will warn investors by posting a “NP (Notice Pending)” sign when a listed company’s board of directors resolves to enter into a Backdoor Listing transaction, until the listed company informs the investors of the result of the SET and the Office of the SEC’s consideration of the Backdoor Listing Application.

B. Relisting

No exemption for the free float qualification under the Relisting rule

The amendment removes the exemption previously granted by the SET for the free float qualification in the Relisting rule. Generally, for the listing of securities of the company formed by amalgamation between a listed and non-listed company and the amalgamation is regarded as a Backdoor Listing – the Backdoor Listing rule must be adopted. Previously, the free float qualification may have been exempted, but that flexibility is no longer available.

[1]The SET has also updated the qualification of the applicant under Regulation of the SET re: Listing of Ordinary Shares or Preferred Shares as Listed Securities B.E. 2558, effective since 1 January 2024 onwards.