In brief

As part of the European Union (EU)’s European Green Deal, one of the areas of EU law that has developed most rapidly and profoundly is that relating to corporate sustainability governance. Most recently, the Corporate Sustainability Due Diligence Directive (“CS3D”), has been provisionally agreed at a political level in December 2023, and confirmed by COREPER in a revised version in March 2024. An overview of this text is available here. The final text of the CS3D must still be formally adopted by the European Parliament and the Council of Ministers before it enters into force.

In this article, we focus on the scope of the CS3D, explaining which companies will be covered and when.

Contents

- How has the scope been scaled-back?

- Overview of the scope

- How to calculate the relevant thresholds?

- What about asset holders / non-operational holding companies?

- Timeline for applicability

How has the scope been scaled-back?

The version of the CS3D approved by COREPER in March 2024 covers fewer companies than the text that was originally agreed in December 2023. Indeed, the applicability thresholds were increased across the board and the approach of setting lower thresholds for companies operating in high-risk sectors was removed. According to data analysed by the Centre for Research on Multinational Corporations (see here), the reduction of scope leads to 5.421 companies being covered by the Directive, which is a reduction of about 60% compared to the rules agreed on in December 2023.

Despite this, the breadth of the impact of CS3D should not be underestimated. First, the scope as approved by COREPER will still cover a significant number of companies, including both those incorporated under the law of a Member State (“EU companies“) and those incorporated under the laws of a third country (“non-EU companies“). Second, both the scope itself, and the approach relating to high-risk sectors may well be reintroduced, at a later stage, pursuant to a future review of the CS3D schedule for six years following the entry into force of the CS3D. Lastly, although not included in scope, small and medium-sized enterprises and other large companies not meeting the thresholds will clearly still indirectly be impacted by the provisions of the CS3D, since the CS3D imposes – among other obligations – value chain due diligence obligations (see here for more details), and many of those smaller companies are bound to be contractors or subcontractors to the companies which are in scope.

Therefore, despite the reduced ambitions of the March 2024 text, the CS3D is still bound to have a significant impact on markets globally, requiring adaptation by most if not all operators.

Overview of the scope

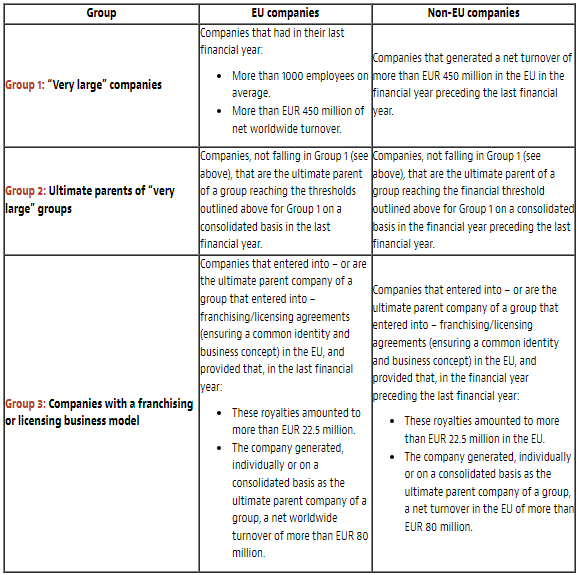

In general terms, we can identify three groups of companies in scope of CS3D, as follows.

How to calculate the relevant thresholds?

The notion of “net turnover” is identical to the one used in the EU Accounting Directive. For most EU companies, it thus covers “amounts derived from the sale of products and the provision of services after deducting sales rebates and value added tax and other taxes directly linked to the turnover”. For non-EU companies, it essentially refers to the notion of revenue used for their own financial statements.

While the CS3D does not define its own notion of what constitutes an “employee”, it remains prescriptive about the types of employment relationships to be counted, and how to count them, for the purposes of the employee thresholds applicable to EU companies, as follows:

- Part-time employees must be included on a full-time equivalent basis.

- Seasonal workers must be included in proportion to the number of months of employment.

- Temporary agency workers and posted workers (from temporary employment undertakings or placement agencies) should be considered as employees of the user company.

- Posted workers should be considered as employees of the sending company.

- Other workers in “non-standard forms of employment” should also be included in the calculation of the number of employees insofar as they meet the criteria for determining the status of a worker established by the Court of Justice of the European Union.

Note that a (EU or non-EU) company or group of companies must meet the above-mentioned (employee and turnover) thresholds for two consecutive financial years to be subject to the obligations set forth in the CS3D. However, once it has been applicable for one year, the CS3D will only become inapplicable if these thresholds cease to be met for each of the last two relevant financial years. This provides some stability to the applicability of the CS3D.

Lastly, one of the key notions of the applicability of the CS3D for non-EU companies is the notion of turnover “generated in the Union”. It is noteworthy that this concept is not defined by the CS3D and remains largely ambiguous. There is little doubt that this notion will be the focus of much analysis and, hopefully, regulatory guidance.

What about asset holders / non-operational holding companies?

Since the ‘Group 2 companies’ category focuses on ultimate parent companies, the CS3D has made specific provisions for cases where such ultimate parent companies are not an operational company. A non-operational ultimate parent company whose main business activity is to hold shares in operational subsidiaries, and which is not involved in management, operational or financial decisions affecting the group (or one or more of its subsidiaries) may be exempted by the competent national supervisory authority from its obligation to comply with the CS3D.

In other words, such parent companies may be allowed to “delegate” their CS3D obligations to one of their operational EU subsidiaries, under certain conditions. If exempted, the ultimate parent company nevertheless remains jointly liable with the designated subsidiary in case the subsidiary does not comply with its obligations under the CS3D. As such, this exemption rule may have an effect on the way that companies organize their internal group structures, including the distribution of responsibilities in terms of management, operational and financial matters. The precise effect on a company’s group must, however, be assessed on an individual basis.

Timeline for applicability

Member States must transpose the CS3D into national law within two years from its entry into force. However, all covered companies are given between one and three more years to prepare.

Indeed, under the March 2024 version of the CS3D, a slower phase-in of the applicability is foreseen than under the originally agreed December 2023 version. The CS3D will start to apply to in-scope companies as follows.

Three years after the entry into force of the CS3D, likely in 2027, the (national transposition of the) CS3D must apply to:

- EU companies that fall within Groups 1 or 2 and had more than 5000 employees on average and generated a net worldwide turnover of more than EUR 1500 million in the last financial year preceding the three-year anniversary of the entry into force of the CS3D.

- Non-EU companies that fall within Groups 1 or 2 and generated a net turnover of more than EUR 1500 million in the EU in the financial year preceding the last financial year preceding the three-year anniversary of the entry into force of the CS3D.

Four years after the entry into force of the CS3D, likely in 2028, the (national transposition of the) CS3D must apply to:

- EU companies that fall within Groups 1 or 2 and had more than 3000 employees on average and generated a net worldwide turnover of more than EUR 900 million in the last financial year preceding the four-year anniversary of the entry into force of the CS3D.

- Non-EU companies that fall within Groups 1 or 2 and generated a net turnover of more than EUR 900 million in the EU in the financial year preceding the last financial year preceding the four-year anniversary of the entry into force of the CS3D.

Five years after the entry into force of the CS3D, likely in 2029, the (national transposition of the) CS3D must apply to all other EU and non-EU companies covered by the CS3D.