In brief

With effect from 26 April 2024, the State Administration of Market Regulation (SAMR)’s Amended Anti-monopoly Compliance Guidelines for Business Operators (“Guidelines“) notably features the provision of credit for antitrust programs verified by the authority.

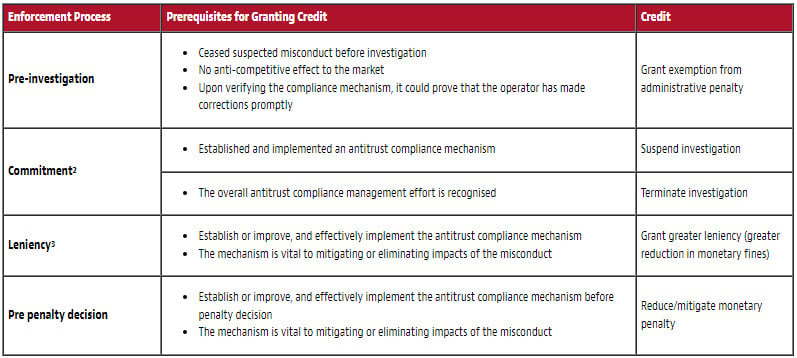

The Guidelines set out for the first time the conditions and process for such credit to be granted.1 The specific prerequisites for granting credit and the type of credit granted varies, depending on the stage of enforcement. Compared with the original 2020 Guidelines, the amended version is more detailed and includes helpful guidance on key antirust risks alongside case studies.

Contents

Key takeaways

Introduction of a comprehensive antitrust compliance incentive policy

Companies that meet certain criteria can receive “credit” before a formal investigation is initiated as well as during the enforcement process:

Granting of credit

The Guidelines also outline the procedures for how credit will be granted to business operators:

- Step 1: Companies can apply to the antitrust authority for antitrust compliance credit.

- Step 2: Antitrust authority will verify whether the company’s compliance mechanism is (i) well designed, (ii) implemented earnestly and in good faith, and (iii) effective. If necessary, a probationary phase may be set up during this process.

- Step 3: Antitrust authority to determine whether to grant credit.

Focus on substance

The SAMR sets out three steps for assessing the substance of the antitrust compliance mechanism, to evaluate whether the:

- Compliance mechanism embeds systematic policies, comprehensive management organization, and an adequate risk management system.

- Business operator has earnestly implemented the compliance mechanism and truly fulfilled the compliance commitments.

- Business operator has set effective compliance review measures.

Forward-looking

Overall, the Guidelines aim to incentivise companies to continuously improve and invest in their existing mechanisms or establish new ones, with a focus on long-term effectiveness and robust compliance practices, rather than merely identifying previous compliance gaps or loopholes. For example, during a probationary phase, the Guidelines encourage and allow for:

- Companies to identify and fix flaws in their existing compliance mechanisms, to minimize the consequences of misconduct and more importantly, demonstrate a reinforced compliance system that can avoid violations.

- Companies without a compliance mechanism in place to proactively set it up with reference to the Guidelines’ framework, while prioritizing the long-term effectiveness of compliance measures.

Competition compliance framework recommended by SAMR

Though the Guidelines comprehensively set out the SAMR’s criteria for an effective compliance system, as summarised below, they also clarify that companies can design a tailored mechanism adequate for its own business scope, governance structure and business scale. SAMR also advises multinational companies to be aware of its antitrust compliance management in other key jurisdictions to ensure stable cross-border operations.

- Management organisation: there should be a compliance management department responsible for overall compliance management; a business department responsible for compliance management in dealings with other businesses, and other functional departments (like audit, legal, risk control) that perform compliance functions in day to day operations.

- Risk management: the Guidelines explain the risks and consequences of cartel conduct, resale price maintenance, abuse of dominance, merger control filings and refusals to cooperate with authority investigations, with an emphasis on identifying, assessing and alert of any antitrust risks.

- Operations: companies should integrate compliance management into all aspects of day to day operations such as internal reporting, training, performance review, inspection and IT systems, and regularly review and improve compliance mechanisms.

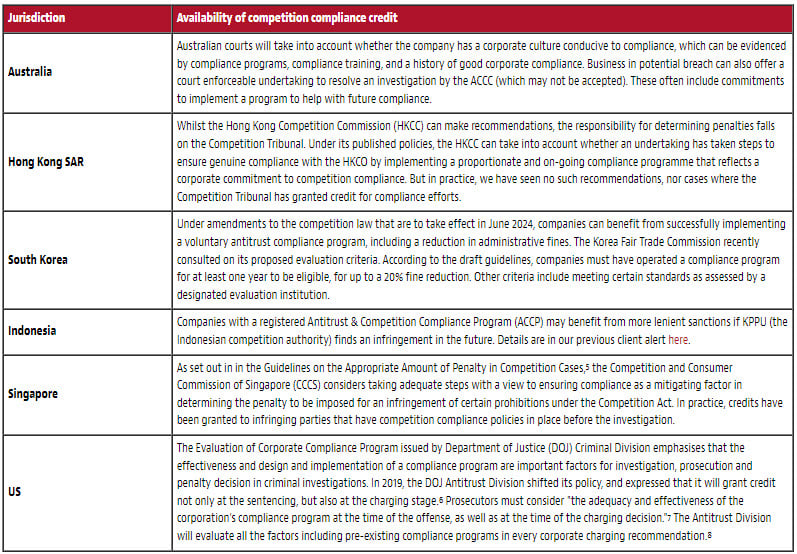

Competition compliance credit in other jurisdictions

Examples of similar policies in Asia Pacific4 and elsewhere include:

Next steps

Companies should take the opportunity to refresh and align their business strategies, while ensuring potential competition law risks are adequately managed. There is an increasing focus on rewarding compliance in some parts of Asia Pacific, and the additional guidance from SAMR offers businesses operating in China clear incentives to do so9. An effective compliance system not only helps mitigate the financial consequences of potential misconduct but can also aid in proactive governance and protect continuity of business operations in the longer run.

1 “Compliance credit” is first mentioned in SAMR’s September 2023 Antitrust Compliance Guidelines for Concentration of Undertakings, but did not expand on any criteria or process.

2 Commitment policy enables operators under investigation to make a commitment to eliminating anticompetitive impacts of its conducts within a given timeframe, and authorities could accept the commitment and decide to suspend and terminate the investigation. Please also refer to Article 53 of the PRC Anti-monopoly Law and the Guidelines for Business Operators’ Commitments in Anti-monopoly Cases for further details.

3 Leniency policy gives an operator, who voluntarily reports to authorities about its monopoly conduct and provides important evidence, full or partial immunity from the payment of fines. Please also refer to Article 56.3 of the PRC Anti-monopoly Law and the Guidelines for the Application of Leniency Policy in Horizontal Monopoly Agreements for further details.

4 See also our Asia Pacific Antitrust and Competition Handbook.

5 See CCCS Guidelines on the Appropriate Amount of Penalty in Competition Cases.

6 See DOJ Antitrust Division Press Release at: Antitrust Division Announces New Policy Incentivize Corporate Compliance

7 See DOJ Antitrust Division Speech at: Assistant attorney general delivers remarks New York University

8 See DOJ Antitrust Division Manual at: Evaluation of Corporate Compliance Programs in Antitrust Investigations

9 There have also been equivalent guidelines issued from local China antitrust authorities in Beijing, Shanghai, Zhejiang and Guangdong province (together with Hong Kong Competition Commission).

******

© 2024 Baker & McKenzie FenXun (FTZ) Joint Operation Office. All rights reserved. Baker & McKenzie FenXun (FTZ) Joint Operation Office is a joint operation between Baker & McKenzie LLP, and FenXun Partners, approved by the Shanghai Justice Bureau. In accordance with the common terminology used in professional service organisations, reference to a “partner” means a person who is a partner, or equivalent, in such a law firm. This may qualify as “Attorney Advertising” requiring notice in some jurisdictions. Prior results do not guarantee a similar outcome.