In brief

On 13 August 2025, the Ukrainian government approved the tender terms, process and timeline for the two oil and gas areas in Western Ukraine, the Mezhyhirska (M) and Svichanska (S) blocks, located near the EU countries bordering Ukraine (Poland, Slovakia and Romania).

Resolutions of the Cabinet of Ministers of Ukraine Nos. 975 and 982 replaced the April 2025 approvals for the tenders of these two blocks. The tenders, framed under the provisions of the PSA Law and the Agreement between the Government of Ukraine and the Government of the United States of America on the Establishment of a United States – Ukraine Reconstruction Investment Fund (“Minerals Deal”), appear to be among the first steps Ukraine has taken in implementing the Minerals Deal.

Production sharing agreement (PSA) bids must be submitted independently for each block. Bids will be assessed separately for each block according to a set of detailed criteria. The most importance will be given to commercial proposals as to the production sharing split, minimum work program, experience in similar projects and industry track record, etc. The tender participation fee will be approximately USD 12,000.

The key baseline parameters for each tender are summarized in the table below.

| Parameters | M block | S block |

| Minerals | Natural gas, shale gas, central basin type gas, gas (methane) from coal deposits, solution gas, dense rock reservoir gas, oil and condensate | |

| Blocks: total acreage, number of sub-blocks, location | 1,515.61 square kilometers Comprises six sub-blocks Lviv, Ivano-Frankivsk, Chernivtsi regions | 872.64 square kilometers Comprises seven sub-blocks Lviv, Ivano-Frankivsk, Chernivtsi regions |

| Minimum financial commitment | Approximately USD 24.5 million* | Approximately USD 24.5 million* |

| Minimum work commitment | Electrometry and gravimetry of the block (excluding areas with completed historical three-dimensional (3D) seismic/unavailable for exploration)Five-year exploration, including the following:400 square kilometer 3D seismic surveyTwo new exploration wellsTwo new deep wellsEnvironmental impact assessmentCompleted exploration report | Electrometry and gravimetry of the block (excluding areas with completed historical 3D seismic/unavailable for exploration)Five-year exploration, including the following:300 square kilometer 3D seismic surveyTwo new exploration wellsTwo new deep wellsEnvironmental impact assessmentCompleted exploration report |

| Bottom-line production sharing split | Cost production: 55%Profit production is split as follows:If the available cost production is insufficient to recover the costs incurred by the investor: investor — 65%; state — 35%If the available cost production is sufficient to recover the costs incurred by the investor: investor — 35%; state — 65% | |

| Investor’s additional undertakings based on the Minerals Deal** | The investor must do the following:Refrain from selling products to prohibited partiesOffer profit production offtake rights to nominated parties, with no sales with more favorable terms if the offer is not acceptedOffer to participate in financing in the case of capital-raising, with no capital raising on more favorable terms if the offer is not accepted | |

| PSA duration | Fifty years | Fifty years |

* Equivalent of UAH 1 billion

** Please read more about the nature of the undertakings in this article.

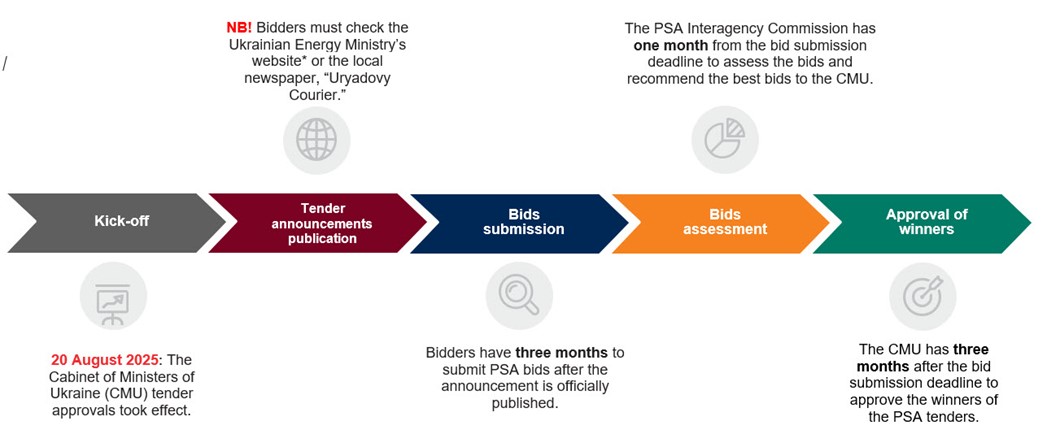

While attempts have been made to start substantive peace talks to stop the war in Ukraine, the government must proceed with the tenders according to a phased, yet flexible, timeline. The chart below outlines the key milestones and approximate timing of the approved tender process for each block.

* Tender announcements will be published on this website.