On 18 October 2017, the Competition and Consumer Amendment (Competition Policy Review) Bill 2017 (Competition Policy Bill) finally passed both Houses of Parliament. Coupled with the Competition and Consumer Amendment (Misuse of Market Power) Bill 2017 (Market Power Bill), which was passed on 23 August 2017, it represents the most significant reform of Australian competition law in the past two decades.

The changes are in response to a series of recommendations emanating from the Harper Competition Policy Review, which identified impediments across the economy that restrict competition and reduce productivity. The landmark amendments aim to simplify the Competition and Consumer Act 2010 (CCA), thereby reducing costs on the economy and burdens on business, as well as promoting pro-competitive behaviour and the adaptability of the law to changing circumstances.

The amendments will commence on the earlier of either a date fixed by Proclamation or six months after the Competition Policy Bill receives Royal Assent.

In this alert, we provide a brief overview of the substantive amendments to the CCA brought about by the new legislation.

Competition Policy Bill Key Changes

Definition of Competition: The definition of competition is amended to confirm that it includes competition from goods and services that are capable of importation, in addition to those actually imported. This change has been made to clarify that a credible threat of import competition is relevant to a competition analysis.

Cartels: Changes have been made to simplify and better target the cartel conduct provisions. Key changes include:

- confining cartel conduct to conduct affecting competition in Australian markets;

- amending the definition of cartel provisions to cover exclusionary provisions and repealing the separate specific prohibition against exclusionary provisions; and

- broadening the scope of the joint venture defence to include procurement joint ventures and remove the requirement that the cartel provision be in a contract – the joint venture defence will now apply if the cartel provision is for the purpose of a joint venture and is reasonably necessary for undertaking a joint venture, so long as the joint venture is not carried on for the purpose of substantially lessening competition.

Price Signalling and Concerted Practices: The price signalling provisions (which have never been the subject of proceedings) are repealed and replaced with a general prohibition on engaging in a concerted practice that has the purpose, effect or likely effect of substantially lessening competition. This prohibition aims to capture anticompetitive conduct that falls short of a “contract, arrangement or understanding”. The only exception will be where the only parties to the concerted practice are the Crown and one or more government authorities.

Third Line Forcing: Third line forcing will no longer be prohibit per se and will instead be subject to a competition test. This will result in Australian law being more in line with overseas jurisdictions such as the US, the European Union and New Zealand which do not specifically prohibited this type of conduct.

Resale Price Maintenance (RPM): Corporations or persons will now be able to notify the ACCC of RPM conduct as an alternative to seeking authorisation. This is considered appropriate as some RPM conduct may be procompetitive and notification is a quicker and cheaper process. The ACCC will be entitled to impose conditions on such notifications. Further, conduct between related bodies corporate is now exempt from the RPM prohibition.

Covenants Affecting Competition: The complex prohibitions on covenants that substantially lessen competition have been repealed and the general prohibition on contracts that substantially lessen competition has been expanded to include covenants.

Notification and Authorisation: The complex provisions governing authorisation have been simplified by introducing a single authorisation process which will include mergers. The ACCC will be the initial decision maker, with reviews to be heard by the Australian Competition Tribunal. Merger authorisations may be subject to conditions. When making merger determinations, the ACCC must take into account any submissions or further information that it has sought and received from the applicant, consultants or others during the process.

The ACCC can also impose conditions on notifications for collective bargaining that involves collective boycott conduct, and can issue a ‘stop notice’, requiring notified collective boycott conduct to cease.

Class Exemptions: The ACCC has been granted a ‘class exemption’ power, allowing it to exempt conduct, or categories of conduct, if it is unlikely to raise competition concerns or is likely to generate a net public benefit.

Admissions of Fact: Section 83 of the CCA is extended so that a party bringing proceedings against a person under certain specified sections of the CCA, may rely on both admissions of fact and findings of fact made in other specified proceedings, in which the person has been found to have contravened the CCA.

Power to Obtain Information, Documents and Evidence: The ACCC’s power to obtain information, documents and evidence under s155 is extended to cover investigations of alleged contraventions of court enforceable undertakings and merger authorisation determinations. A “reasonable search” defence to the offence of failing or refusing to comply with s155 has also been introduced to address the increasing cost of documentary searches resulting from the volume of documents maintained by businesses.

Access to Services: Changes have been made to the National Access Regime to implement recommendations made by the Productivity Commission, to better address the economic problem of an enduring lack of effective competition in markets for nationally significant infrastructure services.

Other Amendments: Various other amendments that are focussed on the requirements of the Australian Consumer Law, will streamline the administration of the CCA, to reduce compliance burdens for business, individuals and within Government, while preserving the protections available.

Market Power Bill Key Changes

As has been widely reported, the s46 test for misuse of market power has been revised and broadened to prohibit a corporation with a substantial degree of market power from engaging in conduct that has the purpose, effect or likely effect of substantially lessening competition in:

- that market;

- any market in which the corporation itself, or a related body corporate, supplies or acquires goods or services or is likely to supply or acquire goods or services or is likely to supply or acquire goods or services; or

- any market in which the corporation indirectly supplies or acquires goods or services or is likely to supply or acquires goods or services.

Importantly, the revised section 46:

- removes the requirement that a corporation ‘take advantage’ of its substantial market power;

- introduces for the first time, an ‘effects’ test in addition to the current ‘purpose test’; and

- removes the specific prohibition on predatory pricing, although, as noted in the Explanatory Memorandum, such conduct will still be subject to the general prohibition against misuse of market power.

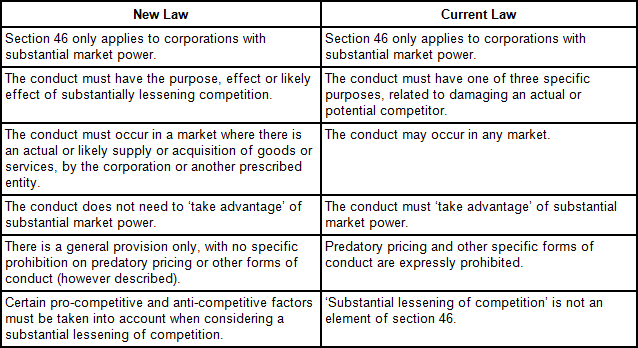

The Explanatory Memorandum to the Bill contains a useful comparative table, which is extracted below:

The Explanatory Memorandum notes that the objective of the new s46 is to target anti-competitive behaviour by firms with substantial market power, while allowing legitimate pro-competitive behaviour, even if this results in harm to inefficient competitors but it confirms that not all actions by firms with substantial market power will be a misuse of that power.

It remains to be seen how the new section will be interpreted and applied by both the ACCC and the Courts. Until more guidance is provided by reported decisions, corporations with substantial market power will need to give very careful consideration to whether conduct that they are engaged in or considering, is likely to have the purpose or effect of substantially lessening competition in the relevant markets in which they operate or are likely to operate.