In brief

On 20 January 2021, the Hong Kong Securities and Futures Commission (“SFC“) and the Office of the Securities and Exchange Commission of Thailand (“Thai SEC“) jointly announced1 (“Announcement“) that they had entered into a bilateral Memorandum of Understanding (“MOU“) for the Mutual Recognition of Funds between the Hong Kong Special Administrative Region of the People’s Republic of China and Thailand (“HK-TH MRF“).2 The HK-TH MRF represents a significant additional step to foster closer ties and financial cooperation between Hong Kong and Thailand. It follows, amongst other existing arrangements, the long term co-operation between the Hong Kong Monetary Authority and Bank of Thailand to explore a Distributed Ledger Technology solution for cross border funds transfers known as project Inthanon – Lionrock3 and the Memorandum of Understanding on the Strengthening of Economic Relations signed on 29 November 2019 by the respective governments.4 In this Client Alert we provide an overview of some of the key aspects of the HK-TH MRF.

What is HK-TH MRF?

Key features

The HK-TH MRF operates on the principle that eligible mutual funds that have been approved by a regulator in one jurisdiction (“Home Regulator“) are, subject to certain conditions, deemed to have complied in substance with the requirements overseen by the regulator of the other jurisdiction (“Host Regulator“). This enables the application of a streamlined approval procedure to facilitate authorization of eligible funds for further public offering in the host jurisdiction.

What are the expected benefits to the mutual funds ecosystem?

The HK-TH MRF will be beneficial to different players in the mutual funds ecosystem, including:

| Mutual Funds: | Subject to compliance with requirements imposed by the Host Regulator:

|

| Investors: |

|

| Fund managers & Brokers: |

|

Regulatory readiness

To facilitate the launch of the HK-TH MRF, simultaneously with the Announcement, each of the SFC and the Thai SEC published the following resources:

| Hong Kong |

|

| Thailand |

|

What types of funds are Eligible?

Broadly speaking, the following types of funds will be eligible to apply for Hong Kong Covered Fund or Thai Covered Fund (collectively “Covered Fund”) status:11

- general equity funds, bond funds and mixed funds;

- feeder funds, where the underlying fund is not itself a feeder fund and falls within one of the fund types in paragraphs (a), (c) and (d) herein, and complies with the relevant eligibility requirements set out in the SFC Circular and SEC Circular (as the case may be);

- unlisted index funds; and

- passively managed index tracking exchange-traded funds (ETFs) including physical gold ETFs.12

Application and Approval Process

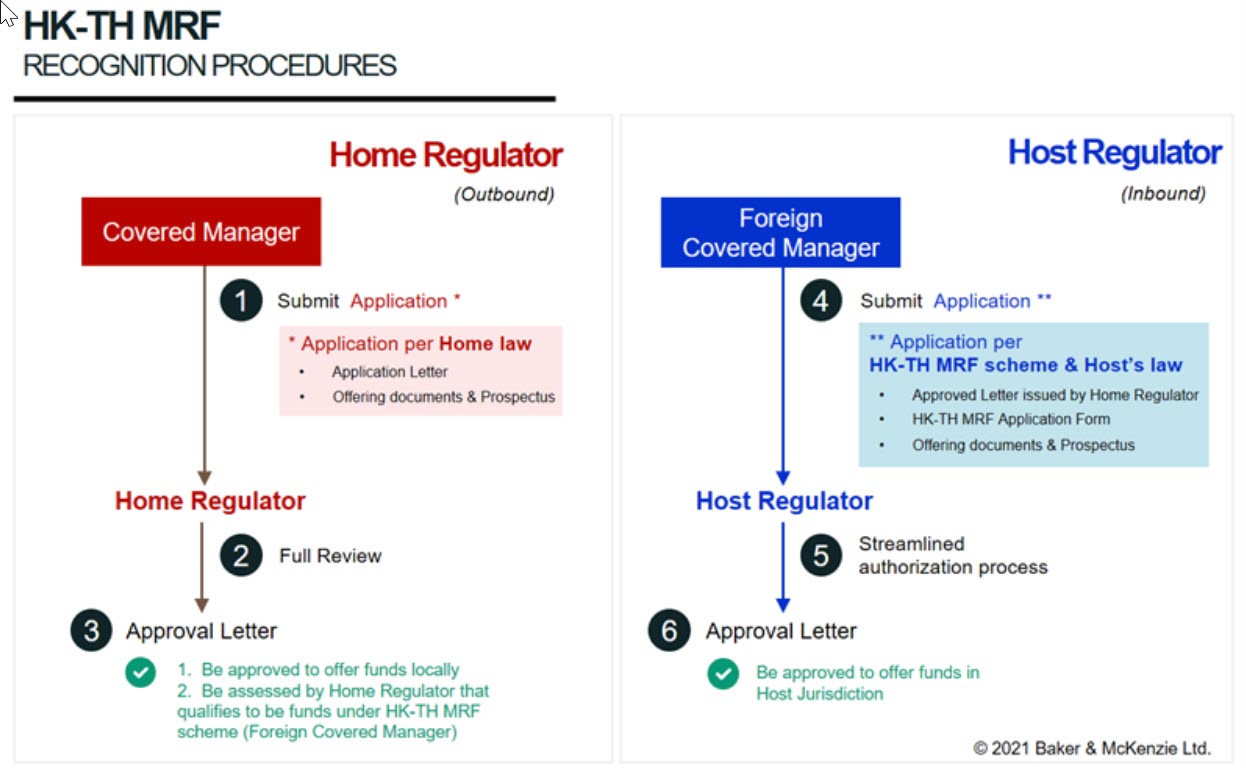

Each of the SFC and the Thai SEC, as Home Regulator, will serve as the outbound gate-keeper for each other. The following diagrams set out the key approval procedures in the home and host jurisdictions.

The process is further explained as follows:

| Outbound | A Hong Kong Covered Manager or Thai Covered Manager (collectively “Covered Managers“) intending to offer interests in Covered Funds under its management in the host jurisdiction is first required to demonstrate that:

|

| Inbound |

|

What are the key ongoing requirements?

In order to provide for investor protection, the requirements applicable to a Covered Fund include:

- a local representative must be appointed in the host jurisdiction in accordance with the relevant local laws and regulations to undertake functions including receiving applications and money for units/shares, issuing contract notes and receiving redemption requests for transfer to the Covered Manager;

- the Covered Fund must remain authorized by its Home Regulator for offering to the public and the Covered Manager must also remain licensed and subject to the Home Regulator’s regulation and supervision on an ongoing basis;

- investors in the host jurisdiction must be able to commence legal proceedings concerning a Covered Fund and the Covered Manager in the local courts of the host jurisdiction;

- investors in Hong Kong and Thailand must be notified at the same time (so far as is reasonably practicable) about any changes to the Covered Fund;

- both the SFC and Thai SEC must be notified of any breach of the requirements under the SFC Circular or SEC Circular and the breach must be rectified promptly; and

- the disclosure of information in offering documents must be complete, accurate, fair, clear and effective and capable of being easily understood by investors.

What is the Implementation Timeline?

The SFC and Thai SEC will endeavour to implement the HK-TH-MRF arrangements within 6 to 12 months following the signing of the MOU and will make further announcements regarding the effective commencement date.

Next Steps

Fund managers who wish to take advantage of the HK-TH MRF arrangement should review the SFC Circular and SEC Circular carefully and consider as follows:

- whether they have any funds that potentially meet the relevant criteria to be considered Covered Funds;

- whether, as a manager, they meet the criteria to make an application to become a Covered Manager;

- what, if any, additions or alterations would be required to be implemented to ensure ongoing satisfaction of the qualification requirements and maintain any approvals;

- whether they have any existing arrangements with local intermediaries and representatives in the host jurisdiction, or if new arrangements need to be established; and

- what the tax implications may be for investors in any cross-border fund arrangement and the extent to which this needs to be addressed in enhanced disclosure materials.

Conclusions

If you have any questions on the topics covered or need further clarification on any particular issue, please do not hesitate to get in touch with your usual contact at Baker McKenzie, or any of the lawyers listed here.

1 https://apps.sfc.hk/edistributionWeb/gateway/EN/news-and-announcements/news/doc?refNo=21PR7

2 https://www.sfc.hk/-/media/EN/files/ER/MOU/MoU-and-Appendices_20210120_Thai.pdf

3 https://www.hkma.gov.hk/media/eng/doc/key-functions/financial-infrastructure/Report_on_Project_Inthanon-LionRock.pdf

4 www.news.gov.hk/eng/2019/11/20191129/20191129_184600_044.html?type=category&name=finance

5 Notification of the Capital Market Supervisory Board No. Tor Jor. 4/2561 Re: Provisions relating to Offering for Sale of Units of Foreign Collective Investment Scheme.

6 See paragraph 10 of the Circular.

7 https://apps.sfc.hk/edistributionWeb/gateway/EN/circular/doc?refNo=21EC1

8 https://apps.sfc.hk/edistributionWeb/gateway/EN/circular/doc?refNo=21EC1

9 https://www.sfc.hk/-/media/files/PCIP/FAQ-PDFS/Hong-Kong-Feeder-Fund-Investing-in-Thai-Master-Fund_20210120.pdf

10 https://www.sec.or.th/TH/Documents/LawsandRegulations/MRF/HK-TH-MRF_SEC-Circular.pdf

11 Please refer to the circulars for the detailed legal descriptions of the eligible funds.

12 Physical gold invested by such gold ETFs must possess a standard and fineness recognized by the London Bullion Market Association.