Baker McKenzie attorneys analyze complications that can ensue when competing companies try to collaborate on sustainability efforts, and they suggest best practices to avoid antitrust problems.

Now that sustainability is a board-level issue, companies are under immense pressure to ensure their supply chains are environmentally and ethically accountable. The motivation may come from internal business, consumers, government, shareholders—or all of them. There are targets, commitments, deadlines, and board pressure match words with deeds.

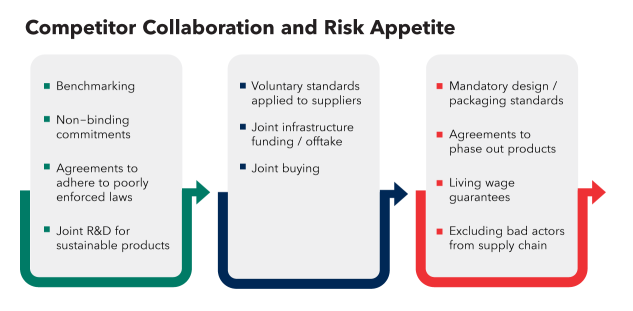

In some markets, companies pursue sustainability goals on their own to profitably bring consumers the products they desire, but a company may not be able to move the needle on its own. A joint or sectoral initiative can sometimes achieve change on a scale that would be commercially impossible for a company to achieve alone. But the prospect of competitors working together can raise issues under US and other antitrust laws around the world.

Regulators cast a wide legal net because the law usually focuses on where an arrangement may have an effect, rather than simply where the parties are located. It is not always clear how national antitrust laws will treat sustainability cooperation that might raise costs and reduce choice.

The result is a complicated and potentially risky legal landscape for companies that want to take decisive action to meet targets and lead in their sector. So how should companies navigate this?

Cartels Not Acceptable

US legislators and antitrust enforcers have sent strong signals they will not tolerate cartels in the guise of sustainability agreements. Companies may be fined and subject to litigation, and publicly accused of greenwashing—which would require time and resources to defend in court and in the public eye.

Federal Trade Commission Chair Lina Khan responded to a question at a Senate hearing by asserting that there is no environmental, social, and governance exemption to antitrust laws. Assistant Attorney General Jonathan Kanter commented, “…when firms have substantial power and they use that power to achieve anti-competitive ends, that should be actionable under the antitrust laws .”

Earlier this year, a coalition of 19 state attorneys general sent a letter to a major investment company expressing concern that “coordinated conduct with other financial institutions to impose net zero raises antitrust concerns.”

In practice, collaborations may not actually intend to restrict competition. Sustainability managers or technical experts may run the projects (under pressure) but have little awareness of antitrust rules because they are not perceived to be in a risky price-setting function.

Those implicated may think that wider laudable environmental or societal aims justify projects in collaboration with competitors. It’s also possible for discussions on legitimate topics to stray into illegal territory, such as prices and the benefits of market stability. Employees may become desensitized to antitrust risks on long-running projects that are subject to scope creep.

Allowable Collaboration

Industry standards and benchmarking are common ways for companies to achieve more sustainable and ethical outcomes. Voluntary standards could have a positive influence over how workers are paid and which manufacturing methods can be used, and even play a role in making recycling more efficient.

There are clear benefits to standards, and many will not raise antitrust issues. However, companies should ensure standards are not developed in a way that disadvantages or excludes—i.e., boycotts—others.

Companies may also need to share information as they develop voluntary standards, verify compliance, or engage in benchmarking. By using non-disclosure agreements, clean teams, or a third party to aggregate the volume figures supplied, they can be made compliant.

Provided that enough firms are involved so no one contributor is able to reverse-engineer information about its competitors, there is no antitrust worry.

Close Calls

The challenge for companies and advisers lies in deciding how to approach projects on the right-hand side of the continuum, where a cost/benefit analysis may be needed.

This is difficult because qualitative benefits are harder to quantify or may be more uncertain, for example. because they will only arise in the longer term. Regrettably, companies might conclude that short-term antitrust scrutiny is more certain than environmental and commercial benefits.

There are no easy answers for this category of projects, and the legal assessment will always be fact- and jurisdiction-specific. We recommend the following tips to mitigate the risk:

- Make sure that those responsible for corporate sustainability initiatives seek out antitrust counsel.

- Consider auditing the ESG activities of the group to ensure in-house counsel knows what is going on and why on any project must be conducted jointly: What about the initiative, in terms of risk and cost, means that it could not be achieved alone?

- Make sure projects preserve as much room as possible for competition, such as by encouraging individual discretion on how to meet and exceed any jointly set targets. Identify and quantify the benefits of the initiative, who will benefit, and when.

Train all employees who have contact with competitors on how to approach meetings, using a dos and don’ts sheet tailored to the project. Ensure each initiative has a compliance program covering information exchange safeguards, and use of a third party to avoid sharing sensitive information. Have corporate counsel periodically check for scope creep, and consider inviting external counsel to key meetings to ensure conversations stay on track.

Also, consider pros and cons of approaching a government body and/or antitrust agency about a contemplated project, which may be a good option where major investments are contemplated.

Don’t Shy Away From ESG

Antitrust law or the perception of it can obstruct legitimate projects focused on achieving more sustainable supply chains, which can be frustrating not only for businesses, but also for antitrust agencies. With careful planning, however, businesses can take steps to ensure that antitrust laws do not stand unnecessarily in the way of legitimate ESG goals.

This article does not necessarily reflect the opinion of Bloomberg Industry Group, Inc., the publisher of Bloomberg Law and Bloomberg Tax, or its owners.