In brief

On 31 January 2023, the Amendment to the Cabinet Office Order on Disclosure of Corporate Affairs was promulgated and came into force (“Amendment“) together with its related guidelines. As a result of this Amendment, it has become a requirement to include a new section in the Securities Registration Statement (Form 7 or Form 7-5) and Annual Securities Report (Form 8 or Form 8-2) (collectively, “Disclosure Statements“) reporting on sustainability-related initiatives and on other matters.

The Amendment applies to Disclosure Statements for fiscal years ending on or after 31 March 2023. Those subject to disclosure duties in Japan and considering the making of a public securities offering in Japan should familiarize themselves with these new disclosure requirements.

FAQ

Q. When will a foreign company whose fiscal year ends on 31 December be required to disclose the new items set forth in the Amendment?

A. The new items must be disclosed in Form 8 or Form 8-2 (Annual Securities Report) starting in FY 2023 (1 January-31 December 2023) or in Form 7 or Form 7-5 (Securities Registration Statement) with audited financial statements for FY 2023.

Q. Will a foreign company which prepares a sustainability report separately from its annual report in its home country need to prepare another separate sustainability report for Japan?

A. Assuming that the existing sustainability report contains the information required under Japanese law, there is no need to prepare a separate sustainability report for Japan. The Amendment does not require the preparation of a sustainability report unique to Japan and as long as the specified sustainability-related information is included in the Disclosure Statements, they are sufficient. In certain cases, it will suffice to disclose the sustainability report disclosed in the home country as part of the Disclosure Statements.

1. Items newly required to be disclosed as a result of the Amendment

1.1 Sustainability approaches and initiatives

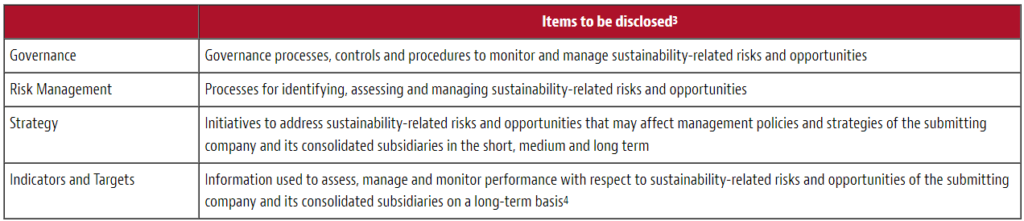

The new items required to be disclosed in the Disclosure Statements are described in the table below. While the Amendment doesn’t define the term “sustainability,” according to the “Principles Concerning Disclosure of Descriptive Information” released together with the Amendment (“Disclosure Principles“),1 sustainability information could include matters related to the environment, society, employees, respect for human rights, anti-corruption, anti-bribery, governance, cybersecurity and data security.2

While it is only a requirement to disclose “Strategy” and “Indicators and Targets,” if a submitting company has material information that falls under these items,5 the following items related to human capital (including diversity of human resources) must be disclosed, regardless of materiality:

- Policies on human resource development, including ensuring human resource diversity and on building the internal environment (e.g., policies on recruitment and retention of human resources and on employee safety and health) have to be described in the “Strategy” section.

- Details of the policy indicators described in (a) above, as well as the targets and achievements using them, have to be described in the “Indicators and Targets” section.

While it is a requirement to disclose sustainability information for the above-mentioned items,6 no disclosure standards have been established in Japan beyond this. Therefore, a submitting company should consider its status in relation to each item explained above when drafting its Disclosure Statements. If the details relevant to the above-mentioned items are being disclosed by the submitting company in its home country through a sustainability report (or any other report), said submitting company may attach said reports to the Disclosure Documents as a part of a “Foreign Company’s Report.”7

While the Amendment does not require any third party assurance in relation to the sustainability information for now, in the future, the provision of assurances may become a requirement.

1.2 Employee status

Each of the following items is newly required to be included in the Disclosure Statements:

- Percentage of female workers in management positions at the submitting company itself and at its consolidated subsidiaries in the most recent fiscal years.

- Percentage of male workers who took childcare leave from the submitting company itself and from its consolidated subsidiaries in the most recent fiscal years.

- Difference in wages between male and female workers at the submitting company itself and at its consolidated subsidiaries in the most recent fiscal years.

The above items may be omitted if the submitting company and its consolidated subsidiaries are not obliged to make public announcements on these items in accordance with the provisions of the Act on the Promotion of Female Participation and Career Advancement in the Workplace (Act No. 64 of 2015, as amended) (“Women’s Advancement Act“). Disclosure requirements under the Women’s Advancement Act apply to companies established in Japan which employ more than 100 workers on a regular basis. According to a response to a public comment made on 31 January 2023, if a submitting company and its consolidated subsidiaries are a foreign company to which the Women’s Advancement Act does not apply, said company will not be obligated to include these items in its Disclosure Statements. In a nutshell, a submitting company established outside of Japan should check whether it has consolidated subsidiaries established in Japan which employ more than 100 workers on a regular basis, and if it does, it should disclose materials prepared by said consolidated subsidiaries in compliance with the Women’s Advancement Act in its Disclosure Statements together with the other required disclosures.8

1.3 Outline of Corporate Governance

The following items are newly required to be included in the Disclosure Statements:

- The activities of the submitting company’s board of directors and any committees or similar bodies established by the submitting company with respect to corporate governance in the latest fiscal year (including frequency of meetings, specific details of deliberations, attendance of individual directors and committee members) although the submitting company may abbreviate reporting on the activities of its voluntarily established committees, except for those that carry out the functions of the nomination committee or the remuneration committee.

- Efforts made to ensure the effectiveness of internal audits.

If the submitting company’s proxy statement and other documents do not contain the information above, the submitting company will need to prepare the relevant statements.

2. Update on forward-looking statements and disclosure responsibilities

In order to prevent companies from minimizing disclosure out of fear of being held liable for false statements due to changes in their businesses following disclosure, the amended Guidelines for the Disclosure of Corporate Affairs (“Disclosure Guidelines“) clarify the duty to disclose forward-looking information (including forward-looking information relating to sustainability).9

The amended Disclosure Guidelines confirm that a submitting company will not be held immediately liable for false statements on account of forward-looking information to the extent that specific, generally reasonable explanations are provided (e.g., where the relevant forward-looking information has been appropriately reviewed internally on a reasonable basis, and where a summary of the review is disclosed with the forward-looking information stating the facts, assumptions and reasoning process upon which the forward-looking information was based).

On the other hand, the Disclosure Guidelines also clarify that the management of a submitting company may be held liable if it fails to disclose material forward-looking information that could affect investors’ investment decisions where said management was aware of said information as of the filing date and withheld said information, and also where the management was not aware of the materiality of the information without reasonable grounds.

To be clear, the amendment to the Disclosure Guidelines does not establish any new obligations to disclose additional forward-looking information (including disclosure of specific figures such as earnings forecasts).

3. Other points

On the same day that the Amendment was announced, the “Good Practices for Disclosure of Descriptive Information 2022” was published10 (Japanese version only) – it includes guidance and disclosure examples relating to initiatives concerning sustainability, employee status and corporate governance which may be helpful when a submitting company is preparing disclosures on new items.

1 https://www.fsa.go.jp/news/r4/sonota/20230131/07.pdf

2 The regulator plans to further revise the Disclosure Principles, including by clarifying the concept of “materiality” relevant to the disclosure of sustainability information, taking into account domestic and international trends.

3 It is not necessary to list the four items separately in the Disclosure Statements.

4 The Disclosure Principles imply that it is not mandatory but recommended that the submitting company actively disclose information on greenhouse effect gas emissions falling into Scope 1 (direct emissions by the company itself) and Scope 2 (indirect emissions from the use of electricity, heat and steam supplied by other companies).

5 According to the Disclosure Principles, even where a submitting company decides not to disclose “Strategy” and “Indicators and Targets” after assessing them to be immaterial, the submitting company should disclose the assessment process and reasons for the determination of immateriality.

6 While a submitting company must state the above-mentioned items in the Disclosure Documents, a submitting company may make references in the Disclosure Documents to other documents released by a submitting company (e.g., a sustainability report published by a foreign company) in order to supplement the information.

7 According to a response to public comments made on 31 January 2023, whether a sustainability report published by a foreign company in its home country can be classified as a “Foreign Company’s Report” capable of being attached to Disclosure Statements will vary from case-to-case in reference to the requirements of the Financial Instruments and Exchanges Act (Act No 25 of 1948, as amended). If the sustainability report is (i) made in English, (ii) publicly available in the foreign country in compliance with foreign laws and regulations and (iii) approved by the Commissioner of the Financial Services Agency in Japan as not being harmful to the public interest or to investor protection considering its terminology, form and method of preparation, the sustainability report can be treated as a “Foreign Company’s Report” that can be attached to the Disclosure Statements. If the sustainability report cannot be deemed a “Foreign Company’s Report,” all relevant disclosures required under Japanese law must be described in the Disclosure Statement (in the form of an attachment thereto) even where the required information is already disclosed in the existing sustainability report

8 On the other hand, the Disclosure Principles also state that efforts should be made to disclose information on a consolidated basis so that it is useful for making investment decisions.

9 In addition, as to false or misleading representations contained in the documents referred to in the Disclosure Statements, the amended Disclosure Guidelines implies that a submitting company will not be immediately liable for the false or misleading statements in those documents except for in cases where a submitting company has referred to such documents knowing that such documents contain clearly false or misleading contents which are material or where the reference to such documents could itself constitute a misstatement.