In brief

The General Authority for Competition (the “Authority“) in Saudi Arabia has recently published its quarterly report on economic concentration applications for Q1 2025. This alert summarizes the key highlights of the report published by the Authority, with particular focus on the issuance of the first conditional approvals of the year.

General statistics

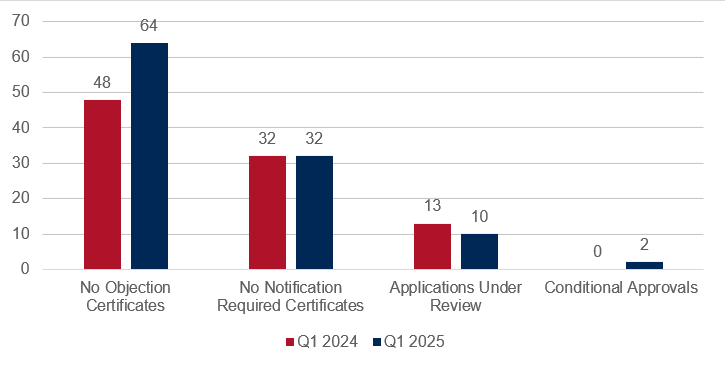

In Q1 of 2025, the Authority received 108 concentration applications, marking a 16% increased compared to Q1 2024. Of these, 64 applications were approved through the issuance of No Objection Certificates, 32 applications approved through the issuance of No Notification Required Certificates, whereas 10 applications remain under review. No application was rejected during this quarter.

Notable uptake in conditional approvals

- The Authority issued two conditional approvals during this period, while it did not issue any conditional approval in 2024. These are the first conditional approvals issued in 2025, indicating the Authority’s readiness to clear transactions subject to certain conditions, undertakings or remedies. This seems to indicate a shift in the Authority’s enforcement approach, suggesting an increased willingness to address competition concerns through tailored remedies rather than outright prohibitions or rejections of transactions.

- The conditions imposed in Q1 2025 reflect a notable evolution in the Authority’s approach. Both recent conditional approvals included a combination of behavioural and structural remedies – ranging from supply obligations and price transparency to divestiture and quality assurance mechanisms – marking a broader and more proactive regulatory strategy. Compared to the Authority’s last conditional approval in 2023, which primarily relied on behavioural commitments around exclusivity, pricing transparency, and fair access in digital retail platforms, the 2025 remedies are more expansive in scope and complexity. They incorporate detailed frameworks designed to ensure supply continuity, competitive neutrality, and compliance verification, signalling a shift toward deeper intervention and long-term oversight in merger remedies.

Breakdown of the data related to mergercontrol filings in Q1 2025

- Acquisitions accounted for the vast majority (83%) of the transactions reviewed, followed by joint ventures (12%), mergers (3%), and agency relationships (1%).

- From a competition perspective, 62% of transactions involved horizontal relationships (i.e., between competitors), while 25% involved conglomerate relationships, and 14% involved vertical relationships.

- Additionally, 80% of the transactions involved foreign entities, highlighting Saudi Arabia’s continued integration into the global M&A landscape, while only 20% involved purely local entities.

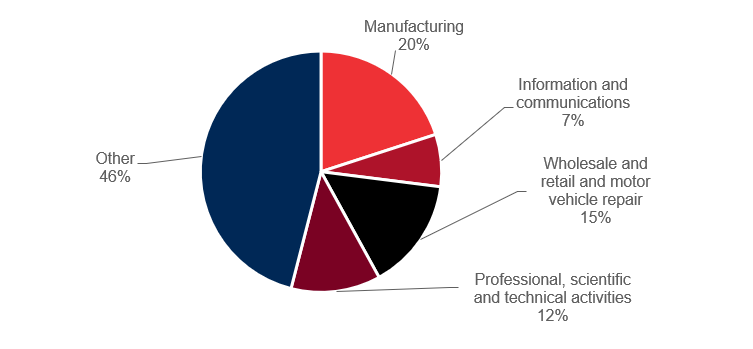

- As shown in the graph below, the manufacturing sector represented 13 merger control filings, followed by wholesale and retail trade (including motor vehicle repairs) with 10 applications, and professional, scientific, and technical activities with 8 applications. The information and communication technology sector followed closely with 7 applications.

For further details on the Saudi Competition Law and its practical impact on your operations in Saudi Arabia, please do not hesitate to contact our Saudi Competition team.

* * * * *

Ruwaa AlAbdullatif, Trainee Associate, has contributed to this legal update.