In brief

On 14 October 2020, Luxembourg announced new provisions with respect to incentive for highly skilled and qualified workers (“Impatriate Regime“) as part of the 2021 budget bill (“Law“).1

The Impatriate Regime was introduced back in 20112 and was further amended by several circulars, including the most recent Circular LIR No. 95/2 dated 27 January 2014 (“Circular“) which have been repealed in the meantime. The government has now decided to codify the Impatriate Regime under Article 115(13) b. of the Luxembourg income tax law (LITL) and to introduce some limited changes.

The aim of Article 115(13) b. of the LITL remains close to the original objective of the Circular, which was to further enhance the competitiveness of Luxembourg by enabling Luxembourg employers to hire new talent from abroad. The changes introduced by the Law should further simplify the procedure, strengthening the clear intention of Luxembourg to remain attractive from an economic perspective.

Below we describe the regime that will be applicable as from 1 January 2021 while highlighting the main changes compared to the former rules.

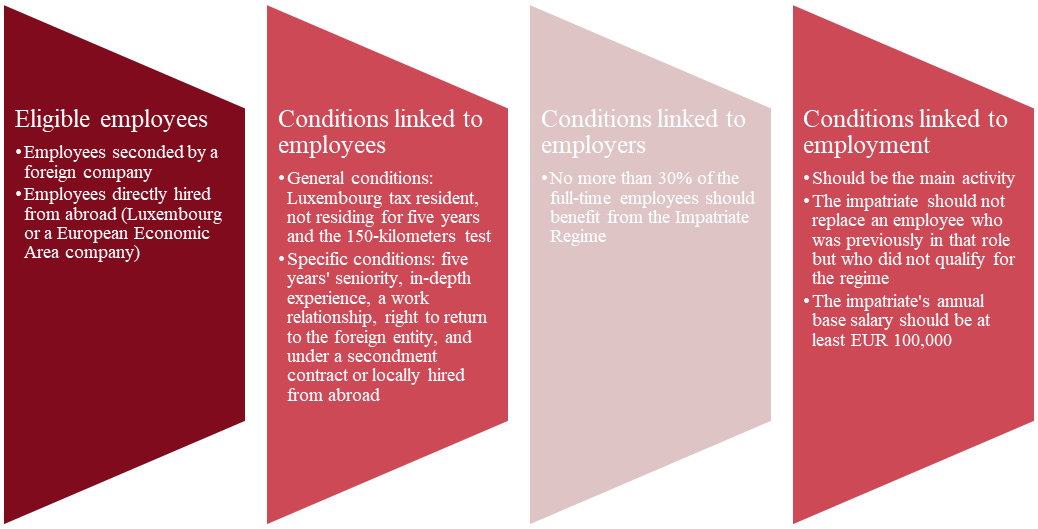

Eligible employees

The Law provides that certain expenses and benefits paid by a Luxembourg employer to an impatriate will not fall within the scope of taxable employment income.

Are eligible:

– employees seconded by a foreign company forming part of an international group to work in Luxembourg for the benefit of a Luxembourg company being part of the same international group

– employees directly hired from abroad by a Luxembourg company or by a company established in another European Economic Area member state in order to work for that company

Such employees qualify as “impatriates” within the meaning of the Law.

Conditions linked to the employees

The impatriate should meet the following conditions to benefit from the provisions of the Law.

- General conditions for employees

- They must be regarded as Luxembourg tax residents.

- The impatriate should not have been resident or subject to income tax in Luxembourg for five years preceding their employment in Luxembourg and they should not have lived at a distance of less than 150 kilometers from the Luxembourg border.

It is noteworthy to stress that the 150-kilometer test that exists in the Circular and that is maintained in the Law’s provisions could be recognized as a violation of European Union (EU) law. In its commentaries to the draft bill the Chamber of Commerce made a reference to Sopora case (C-512/13) dated 24 February 2015 opposing the Netherlands and M. Sopora, the European Court of Justice (ECJ) ruled that the 150-kilometer test applicable under the Dutch impatriate scheme was not contrary to the freedom of movement for workers laid down in Article 45(2) of the TFEU to the extent that: i) the extraterritorial expenses incurred by a worker residing at a distance of less than 150 kilometers from the border could still benefit from an exemption; and ii) the Dutch impatriate scheme does not systematically give rise to a net overcompensation in respect of the extraterritorial expenses actually incurred so that there should be no systematic discrimination between workers residing within 150 kilometers and those residing at a distance of more than 150 kilometers.

It is noteworthy to stress that the 150-kilometer test that exists in the Circular and that is maintained in the Law’s provisions could be recognized as a violation of European Union (EU) law. In its commentaries to the draft bill the Chamber of Commerce made a reference to Sopora case (C-512/13) dated 24 February 2015 opposing the Netherlands and M. Sopora, the European Court of Justice (ECJ) ruled that the 150-kilometer test applicable under the Dutch impatriate scheme was not contrary to the freedom of movement for workers laid down in Article 45(2) of the TFEU to the extent that: i) the extraterritorial expenses incurred by a worker residing at a distance of less than 150 kilometers from the border could still benefit from an exemption; and ii) the Dutch impatriate scheme does not systematically give rise to a net overcompensation in respect of the extraterritorial expenses actually incurred so that there should be no systematic discrimination between workers residing within 150 kilometers and those residing at a distance of more than 150 kilometers.

- Specific conditions for seconded employees

In case of seconded employees, the Law provides that the following conditions must be met:

– The impatriate must have five years’ seniority within the international group or five years’ specialized professional experience in the relevant sector of activity.

– A “work” relationship between the seconding group entity and the seconded employee must exist during the secondment of the impatriate in Luxembourg.

– The impatriate must have the right to return to the foreign entity once the secondment period has expired.

– A secondment contract between the foreign entity and the Luxembourg entity to which the employee is seconded must exist.

![]() The additional condition according to which the employee had to demonstrate their specialization in a sector of activity or profession that is subject to recruitment issues in Luxembourg is no longer required.

The additional condition according to which the employee had to demonstrate their specialization in a sector of activity or profession that is subject to recruitment issues in Luxembourg is no longer required.

Conditions linked to the Luxembourg employer

- The number of employees benefiting from the Impatriate Regime should not exceed 30% of the full-time employees except for companies existing for less than 10 years

The condition according to which the Luxembourg employer should employ or commit itself to employ at least 20 full-time employees in the medium term is no longer required.

The condition according to which the Luxembourg employer should employ or commit itself to employ at least 20 full-time employees in the medium term is no longer required.

Conditions linked to the employment

The conditions are as follows:

- The employment activity must be the main activity of the impatriate.

- The impatriate cannot replace any other employee not concerned by the provisions of Article 115(13) b. of the LITL.

The following conditions have changed compared to the Circular:

The following conditions have changed compared to the Circular:

- The fixed threshold of an employee’s remuneration is now EUR 100,000 under the Law whereas it was EUR 50,000 under the Circular.

- Hiring an impatriate does not expressly require the impatriate to bring their specific knowledge to the company or to have specific skills in a sector or profession characterized by recruitment difficulties in Luxembourg anymore. These changes have been made to limit the administrative burden as these conditions were already implied in a situation where the employer has the obligation to report any vacancies to the state employment agency and to report that none of the Luxembourg resident candidates meet the requested qualifications and experience.

Expenses and costs

According to the new provisions of article 115 13b) LITL, are exempt the following costs generated by the impatriate move from abroad to Luxembourg and paid for by his employer:

- moving costs to transfer the domicile of the impatriate from abroad to the Grand Duchy;

- furniture costs;

- travel expenses as a result of special circumstances related to the family situation of the impatriate;

- the costs of definitive return to the State of origin after the assignment of the impatriate, including the costs incurred by the move;

- the accommodation costs of the residence in Luxembourg if the former habitual residence of the expatriate remains maintained in his State of origin or, if this is not the case, the differential of cost of housing;

- the cost of an annual travels between Luxembourg and the State of origin for the employee himself, his spouse or partner and the children of his household;

- fiscal equalization of domestic taxes in order to compensate for the differential in the tax burden between Luxembourg and the State of origin;

- additional school fees;

- 50% of the relocation bonus granted to a qualifying employee (limited to the lesser between EUR 50,000 (EUR 80,000 for households subject to joint taxation) and 30% of the gross regular annual remuneration of the employee (i.e. excluding variable part and other benefits))

Duration of the regime and reporting obligations

The incentives will apply until the end of the employment in Luxembourg and at the latest until the 8th fiscal year following the year the qualifying employee is relocated to Luxembourg.

In terms of reporting obligations, Luxembourg employers should declare at the beginning of each year (i.e., by 31 January at the latest) the name of the employees benefiting from the provisions of the Law. Foreign employers that do not have tax withholding obligations in Luxembourg and that do not elect to withhold tax on a voluntary basis are not subject to this reporting obligation. In this specific context, the impatriate employee will have to file an individual income tax return to benefit from the Impatriate Regime.

Entry into effect and transitional period

The provisions of the Law should enter into effect as from fiscal year 2021.

Further guidance in the form of a Grand Ducal Regulation is expected regarding the transition between the provisions of the Circular and the Law.

Conclusions

The provisions introduced by the Law aim to adapt the favorable incentive scheme currently available under the Circular while simplifying the conditions of access to the scheme. The extension of the duration of the tax scheme from five to eight years and the removal of certain conditions for impatriates (i.e. no need to bring specific knowledge to the company) or employers (i.e., the scheme is not limited to employers with a minimum number of employees) highlight the intention of Luxembourg to maintain a favorable economic climate to attract and keep new talent from across the world. The impatriate tax scheme, apart from being codified and simplified, has not significantly changed and it remains available to any employer planning to hire highly skilled workers from abroad. Our Luxembourg Baker McKenzie experts in employment law and tax law would be happy to assist you in setting up such opportunity.

1 Bill of Law 7666 on the 2021 budget adopted 15 December 2020

2 Circular LIR No. 95_2 of 31 December 2010.