In brief

On 8 January 2021, the Luxembourg tax authorities released Circular L.I.R. No. 168bis/1 (“Circular”) providing guidance on the application of the interest deduction limitation rule introduced by the Law of 21 December 2018 (“Law”) implementing the Anti-Tax Avoidance Directive (EU) 2016/1164 of 12 July 2016 (ATAD).

According to the provisions of the Law inserted in Article 168bis of the Luxembourg Income Tax Law (LITL), “exceeding borrowing costs” incurred by a taxpayer in a tax period are only deductible up to the higher amount of 30% of the taxpayer’s earnings before interest, tax, depreciation and amortization (EBITDA) or EUR 3 million. As mentioned in the commentaries of the preliminary draft of the Law and in accordance with the purpose of the ATAD, the aim of these provisions is to discourage companies from reducing their global tax liability through excessive interest payments.

Contents

- Recommended actions

- In depth

- Definition of borrowing costs

- Determination of borrowing costs

- Details on certain borrowing costs

- Symmetric approach

- Determination of the exceeding borrowing costs and the interplay with the recapture mechanism

- The limits of the carryforward of unused interest deduction capacity

- The grandfathering rule and other exclusions

- Loans used to fund long-term public infrastructure

- Stand-alone entities

- Definition of borrowing costs

- Conclusions

This rule — applicable since 1 January 2019 — has raised a certain number of practical questions that the Circular intends to answer by providing details on the following items:

Recommended actions

Even though the awaited Circular provides some clarifications on certain concepts such as borrowing costs (without providing a clear definition of “interest”), its application in practice remains unclear, especially with respect to securitization vehicles/application within tax consolidation groups and, sometimes, notably, when determining the carryforward deduction capacity as shown in our example below. As this interest limitation rule could negatively affect your business strategy, we highly recommend the following:

- Anticipate by identifying the borrowing costs incurred by your company and subject to the interest limitation rule.

- Track by maintaining an accounting diligence process in case there are any challenges by the Luxembourg tax authorities.

- Document your tax returns substantially by providing clear allocations between expenses subject to the interest limitation rule and those out of scope.

In depth

The purpose of this alert is to provide you with an overview of the key elements provided by the Circular when applying the interest deduction limitation rule.

Definition of borrowing costs

To determine the “exceeding borrowing costs” that will be taken into account for the application of the interest limitation rule, it is important to more narrowly define what “borrowing costs” are. Under the provisions of Article 168bis of the LITL, “borrowing costs” include interest expenses on all forms of debt and other costs economically equivalent to interest, as well as expenses incurred in relation to financing. In particular, the Law provides a non-exhaustive list of “borrowing costs,” which includes remuneration under profit participating loans, interest expenses on convertible bonds and zero coupon bonds, notional interest on derivative instruments, etc.

Determination of borrowing costs

To determine whether the expenses are borrowing costs within the meaning of Article 168bis of the LITL, the two-step approach below should be followed:

- Determining whether operating expenses and acquisition costs are eligible borrowing cost

The Circular highlights that expenses incurred by the taxpayer that are not exclusively raised by the company and that are not to acquire, secure or maintain a certain level of income should not qualify as operating expenses or acquisition costs and, therefore, could not fall under the definition of “borrowing costs.” As an example, a hidden profit distribution is out of the scope of the definition of “borrowing costs.”

The Circular also stresses that other provisions may have an impact on the determination of eligible borrowing costs such as the anti-hybrid rules. In that situation, the deductibility of operating expenses or acquisition costs would be denied and, therefore, would not be considered eligible borrowing costs. Regarding the potential interaction of the various anti-abuse clauses in tax matters, the special provisions prevail over the general provisions. Thus, if an abusive tax structure falls within the scope of a special anti-abuse clause such as the interest limitation rule, the special provision is intended to apply. However, it should be noted that while the constituent elements of the anti-abuse provisions are not met, the general anti-abuse clause is likely to apply due to its general purpose.

- Determining whether operating expenses and acquisition costs fall under Article 168bis (1) 2) of the LITL

The guidance expressly refers to the Organization for Economic Cooperation and Development’s (OECD) report on Action 4. Note that no details or guidance is provided on the definition of “interest” as such. However, the following non-exhaustive list of borrowing costs is included.

Details on certain borrowing costs

- Redemption and issuance premiums: With respect to interest incurred on convertible bonds and bonds without coupon, the Luxembourg tax authorities further confirmed that redemption and issuance premiums due on these instruments should be considered borrowing costs for the purpose of Article 168bis of the LITL.

- Real estate: The Circular states that interest on amounts borrowed to finance new installations could only be incorporated into acquisition prices to the extent the link between the loan and the investment is direct and effective. Additionally, those capitalized interests could only be assimilated into borrowing costs when they are deducted, notably in the case of amortization, deduction for depreciation or the sale of the new installation.

- Transfer pricing: Any adjustment passed on the interest charge to comply with the arm’s length principle should be subject to the interest limitation rule.

- Foreign exchange gains and losses: In its opinion on the draft of the Law (7318/02), the State Council requested clarification as to whether foreign exchange gains and losses were to be considered interest for the purpose of Article 168bis of the LITL. The point has now been clarified by including any foreign exchange gain or loss proportionally linked to financing to the concept of “borrowing costs” and by excluding any foreign exchange gain or loss incurred on the principal.

- Discounted debt: The Circular also specifies that impairments of doubtful accounts or irrecoverable debts should not be considered “borrowing costs.”

- Fees: The fees incurred upon the borrowing of funds, e.g., opening and account maintenance fees, are considered “borrowing costs” under the Law. However, the fees incurred and paid to intermediaries, such as a notary, experts, etc., are expressly excluded from the definition.

Symmetric approach

Since the notion of interest income is not defined in the law, a symmetric approach needs to be adopted, i.e., what constitutes an interest expense on the borrower’s side should constitute an interest income on the lender’s side and the other way around. This is an important clarification, since the exceeding borrowing costs result in the difference between, on the one hand, the deductible borrowing costs and, on the other hand, the taxable interest income and other economically equivalent income. Uncertainty about the determination of the interest income would lead to the difficult — or even impossible — application of the rule.

Therefore, the interest income should mirror the interest expenses as a strict application of the symmetric approach.

The choice of the symmetric approach was quite predictable, as it was considered the best approach at an international level under the OECD report on Action 4, as well as at a national level under the commentaries on the bill of law released by the Council of State and the Chamber of Commerce. Indeed, in the 2019 Luxembourg tax return complement regarding the determination of the exceeding borrowing costs of a taxpayer, the Luxembourg tax authorities implicitly opted for the symmetric approach, as it requires the taxpayer to provide information about borrowing costs as well as interest income and other equivalent revenues.

Finally, symmetry is also the approach applied by our neighboring countries Germany, France and the Netherlands.

Determination of the exceeding borrowing costs and the interplay with the recapture mechanism

The guidance indicates that only the tax-deductible borrowing costs of the taxpayer must be considered for the purpose of computing the “exceeding borrowing costs.” In other words, the borrowing costs that would already not be deductible under the anti-hybrid mismatches rules (Article 168ter of the LITL) or that would not be deductible because they have a direct economic connection with tax-exempt income (Article 45, paragraph 2 of the LITL and Article 166, paragraph 5, point 1 of the LITL) should be excluded from the computation of the “exceeding borrowing costs.”

Conversely, borrowing costs with a direct economic connection with a qualifying participation under the Luxembourg participation exemption regime should not be considered “in recapture” (within the meaning of the Grand-Ducal Regulation of 21 December 2001) if these borrowing costs are not deductible under Article 168bis of the LITL (see examples 7 and 8 depicted in the Circular).

This clarification is welcome as it prevents the double taxation of the same borrowing costs that could be considered non-deductible twice under the combined application of Article 168bis of the LITL and the Grand-Ducal Regulation of

21 December 2001. However, the interplay between the aforementioned “recapture rule” and Article 168bis of the LITL has not been entirely solved.

Indeed, there is no reference to the case where exceeding borrowing costs historically related to a qualifying participation and not deducted in a previous year according to Article 168bis of the LITL would be carried forward under Article 168bis, paragraph 4 of the LITL and deducted in a subsequent year. In such a case, should these borrowing costs be considered retrospectively in “recapture” in the application of the Grand-Ducal Regulation of 21 December 2001?

The limits of the carryforward of unused interest deduction capacity

The meaning of EBITDA used in Article 168bis of the LITL should be understood as fiscal EBITDA. In other words, for the purpose of computing fiscal EBITDA, only taxable income is taken into account — meaning that exempt income, such as income derived from qualifying participations or income not taxable in Luxembourg according to a double tax treaty, does not affect fiscal EBITDA. As a result, expenses with a direct economic connection with exempt income are not deductible for the purpose of computing fiscal EBITDA.

The paper remains silent on whether the carryforward of the exceeding borrowing costs without limitation in time (provided in Article 168bis, paragraph 4 of the LITL) consists of an option offered to the taxpayer or if it automatically applies when possible. Following a strict interpretation of Article 168bis of the LITL, the carryforward of exceeding borrowing costs should remain an option, meaning that a taxpayer should have the choice of the year during which its exceeding borrowing costs carried forward may be deductible. As such, a taxpayer may prefer to deduct its exceeding borrowing costs carried forward during a year where no exempt dividend is derived (to avoid the potential application of Article 166, paragraph 5, point 1 of the LITL). Note, however, that the Circular does not confirm such possibility.

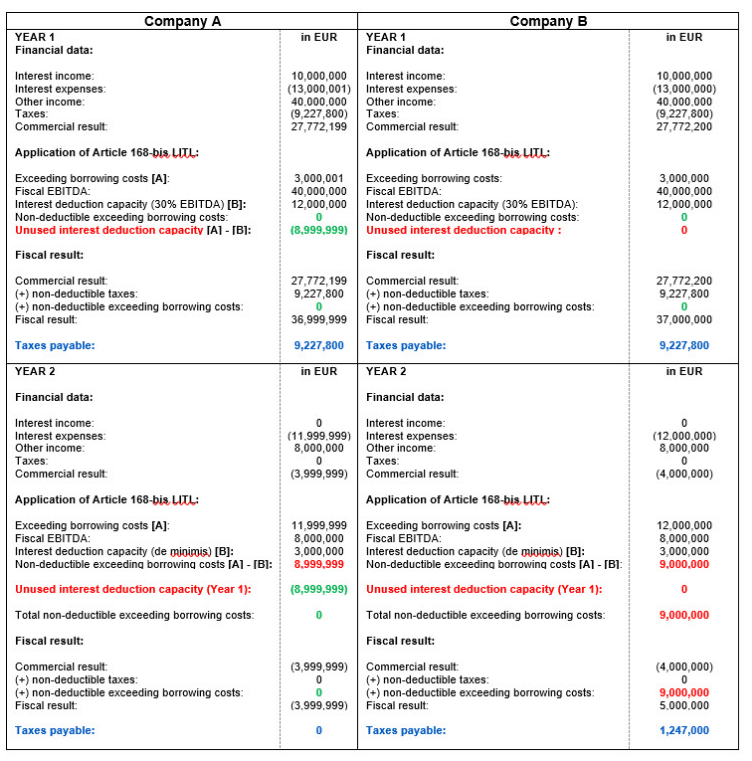

Moreover, based on a strict reading of Article 168bis, paragraph 3 of the LITL, a taxpayer may benefit from an unused interest deduction capacity (i.e., defined as the amount by which 30% of taxable EBITDA exceeds the amount of the exceeding borrowing costs) that may be carried forward over five years under the condition that the exceeding borrowing costs incurred exceed EUR 3 million. The guidance goes in the same way and confirms that the unused interest deduction capacity implies that the taxpayer incurs more than EUR 3 million of exceeding borrowing costs. It is questionable whether this prerequisite will lead to, in practice, certain taxpayers being unfairly denied (i.e., taxpayers that do not incur more than EUR 3 million of exceeding borrowing costs) the possibility of constituting an unused interest deduction capacity. Such difference between taxpayers could potentially constitute unlawful discrimination and be seen as contrary to the spirit of the law that introduced Article 168bis of the LITL. Indeed, the aforementioned prerequisite leads to taxpayers that incur more exceeding borrowing costs being favored. This is contrary to the spirit of the law, which was initially aimed at discouraging excessive interest payments (Draft Law No. 7318, page 18). In comparison, the French interest deduction limitation rule seems to allow taxpayers to constitute unused interest deduction capacity without any prerequisites (i.e., there is no need for the taxpayer to incur at least EUR 3 million of exceeding borrowing costs).

The example below should illustrate the point above:

The grandfathering rule and other exclusions

The interest deduction limitation rule should not apply to loans concluded before 17 June 2016. However, if such loans are amended after this date, the interest deduction limitation rule should then apply. The Circular clarifies the situations in which the grandfathering rule does and does not apply. Accordingly, any change in relation to the duration of the loan or the interest rate as from 17 June 2016 that was not contractually agreed before this date should be considered as an amendment excluded from the grandfathering rule.

Conversely, changes to the duration of the loan or the interest rate as from 17 June 2016 that were contractually agreed before this date should benefit from the grandfathering rule.

The grandfathering rule also applies to drawdown payments made as of 17 June 2016 within the framework of a loan agreement agreed before this date and in accordance with the conditions applicable to this contract (i.e., in accordance with the credit ceiling agreed before 17 June 2016).

Additionally, the transfer of seat or central administration to Luxembourg from a company that is a party to a loan agreement concluded prior to 17 June 2016 without any amendment passed to the conditions of this loan agreement should also benefit from the grandfathering rule.

Conversely, amendments passed to the loan agreement with respect to the amount borrowed as of 17 June 2016 and changes to one or several parties to the loan agreement as of 17 June 2016 are not covered by the grandfathering rule.

The examples provided are not exhaustive and other situations may be envisaged.

Loans used to fund long-term public infrastructure

Similarly, loans used to fund long-term public infrastructure located in the European Union are outside the scope of the interest deduction limitation rule to the extent the long-term infrastructure project provides, upgrades, operates or maintains a large-scale asset that must be considered to be of general public interest. A list of criteria to be met to fall under this exception is included. One criterion is that the asset linked to the interest excluded should be recognized as of public interest. Infrastructures such as schools, swimming pools, universities, libraries or theaters could generally meet the public interest criteria.

Finally, the Circular insists on the importance of a strict accounting allocation to be made by the taxpayer between interest expenses in relation to the exclusion and those falling under the limitation. In the event the allocation is difficult to operate, the taxpayer should determine an allocation key based on objective and easy-to-check criteria.

Stand-alone entities

“Stand-alone entities” are entities that are not part of a consolidated group for financial accounting purposes. Entities with no associated enterprise or permanent establishment located in another country are also excluded from the application of the interest limitation rule. In this respect, it is further explained that the “association test” should apply not only to companies in which the taxpayer holds a participation, but also to its shareholders. The existence of a direct or indirect link between the taxpayer and the other entity should be assessed from an economic perspective.

Based on the above-mentioned provisions, a securitization company entirely held by a single orphan entity (such as an Anglo-Saxon charitable trust or a Dutch stichting) will not be viewed as a stand-alone entity and, therefore, will fall under the scope of the interest deduction limitation rule.

Conclusions

The Circular released by the Luxembourg tax authorities provides interesting guidance on the concept of borrowing costs and some practical examples regarding the application of the rule. Unfortunately, it does not provide clarification on securitization vehicles and it leaves many questions unanswered concerning the interplay of this provision with other rules, the computation of the carryforward of the deduction capacity and the application to tax-consolidated groups. Much like the other ATAD provisions, it is important that taxpayers identify the impact of the interest deduction limitation rule on their business. We therefore highly recommend assessing this risk at an early stage in order to anticipate any adverse impacts. Our tax experts at Baker McKenzie Luxembourg would be pleased to assist you in this process.