In brief

In December 2019, Myanmar’s first Anti-dumping Law (“ADL“) was passed by the Assembly of the Union of Myanmar (Pyidaungsu Hluttaw), marking the introduction of a legal framework for the imposition of anti-dumping measures in Myanmar for the first time. Although Myanmar has been a member of the World Trade Organization (“WTO“) since 1995, Myanmar did not have a national anti-dumping law until the passing of the ADL. The new legislation is expected to enter into force on 1 July 2021.

Contents

In a Glance

The ADL provides for a legal framework for investigating alleged dumping by foreign exporters for the purposes of determining and applying anti-dumping measures where dumping is established. As Myanmar is a WTO member, we note that some of the key principles enshrined under the WTO Agreement on Implementation of Article VI of the GATT 1994 (also known as the “WTO Anti-Dumping Agreement“) are reflected in the ADL, while other notable deviations from the Agreement are found in the legislation.

Key Features of the Anti-Dumping Law

Anti-dumping measures are generally introduced to protect domestic producers from dumping activities by foreign exporters (in this case, exporters who export goods into Myanmar), which could hurt the local industry.

Under the ADL, the term “dumping” is defined as an increase in the volume of imported products, either in absolute terms or relative to the production of like or competing products. This is in contrast with the meaning of “dumping” under the WTO Anti-Dumping Agreement which generally refers to a situation of international price discrimination, where the price of a product when sold in the importing country is less than the price of that product in the market of the exporting country.

Pursuant to the ADL, a domestic producer who sustains material injury or threat of it due to dumped imported goods may apply for anti-dumping measures to be imposed by an anti-dumping committee (“Committee“) which will be established and charged with the responsibility of carrying out anti-dumping investigations upon receipt of applications by domestic producers.

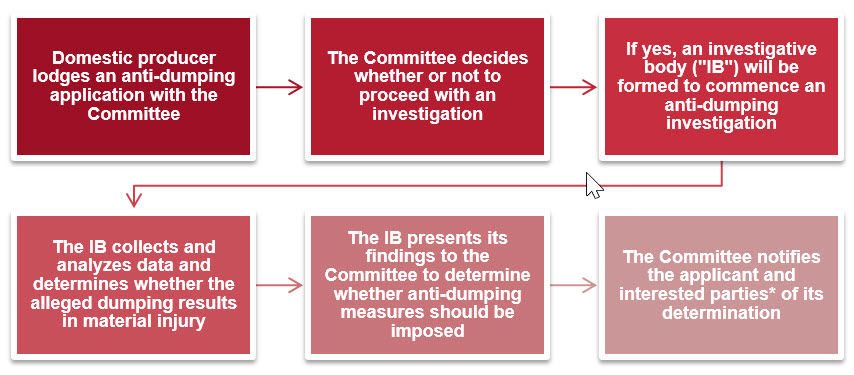

An anti-dumping investigation generally entails the following processes:

*”Interested parties” include foreign exporters or producers of the subject product, importers of the subject product and trade and business associations where the majority of its members comprise of import, exporter and producers of such product, governments of the country exporting the subject product, domestic producers and trade and business associations where the majority of the members are domestic producers of the subject product.

The IB will consider the information obtained from domestic producers in respect of the following factors in determining whether or not the dumped import causes material injury or the threat of it to the establishment of domestic producers’:

- volume and rate of dumped imports;

- market share that the dumped product acquired in the domestic market;

- change in the rate of sales of the subject product;

- change in production level in respect of the subject product;

- change in the production capacity of the subject product; and

- change in employment rate.

Following an anti-dumping investigation, where it is found that dumping exists and has caused material injury (or threat of material injury) to the domestic producers, the Committee is empowered to:

- impose anti-dumping duty on the subject products, and/or

- limit the quantity of import of the subject products.

In determining the applicable anti-dumping measure, the Committee shall impose measures only to the extent that the measure remedies the injury suffered by the domestic producers. The ADL provides that the initial period for any such measure on a product is up to a period of four years. The anti-dumping measure may, however, be extended by the Committee upon application by the domestic producer, up to a maximum of 10 years.

Interested parties who are dissatisfied with the determination may file an appeal to the Tax Appellate Tribunal in order to review any anti-dumping duty imposed within 30 days from the date a notice relating to the same is issued.

Conclusion

With the coming into force of the ADL, exporters of goods to Myanmar should keep a lookout for potential anti-dumping investigation initiated by the Myanmar government on their goods, and be ready to proactively respond to any relevant anti-dumping investigation to ensure the cost competitiveness of their products in Myanmar.