The Financial Services Regulatory (FSR) Momentum Monitor is a horizon-scanning tool enabling financial service providers to plan and prepare for coming developments across the jurisdictions in which they operate.

Grouping upcoming changes into key business-relevant themes, the FSR Momentum Monitor highlights the extent and expected impact of upcoming regulatory intervention in multiple jurisdictions across the globe.

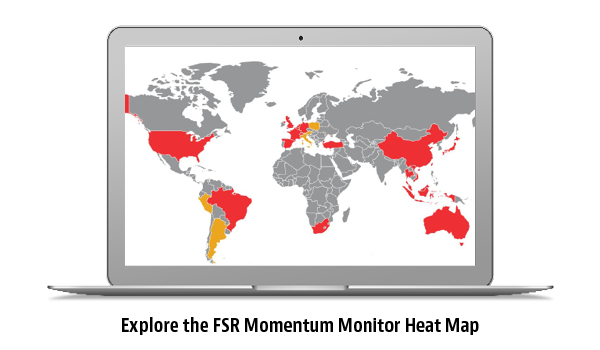

Analysis by our experts is accessible via a heat map, and organized into the following themes:

- Environmental, Social and Governance (ESG)

- Governance and culture

- Operational risk and resilience

- Fintech, AI and data

- Financial crime

Cross-border momentum toward increased regulation, or a common approach adopted by regulators, is examined in our accompanying global commentary, available below.

The FSR Momentum Monitor is designed to complement the award-winning Global FSR Regulatory Guide on authorization and licensing requirements.

Momentum analysis

In this first snapshot, most jurisdictions are largely showing either red — denoting significant change or amber — the potential to impact affected firms. This is unsurprising given the increasing interconnectedness of global financial markets and the growing influence of international standard-setting bodies and their recommendations to regulators. Undoubtedly, the trend area now seeing most momentum is regulation around fintech and new technologies.