In brief

Malaysia recently launched the Corporate Green Power Programme (“CGPP“), a renewable energy initiative that allows corporate consumers to virtually purchase solar energy from solar developers. This is achieved through the use of virtual power purchase agreements (“VPPA“), or Corporate Green Power Agreement (“CGPA“). Our previous alerts issued on the CGPP can be found here and here.

This alert explains the mechanism of CGPP and sets out the potential investment opportunities and benefits to corporate consumers, particularly those with plants and factories that have high energy usage.

In detail

Corporate Green Power Agreement (“CGPA”)

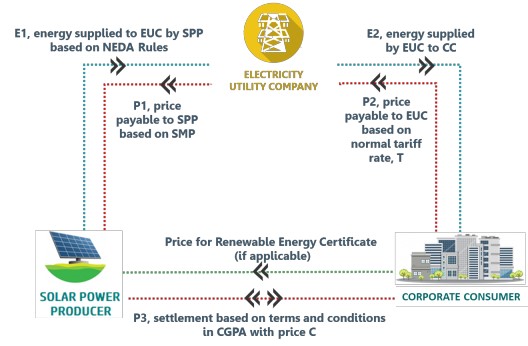

- The CGPA is a financial transaction between a corporate consumer and a solar developer that does not involve the physical transfer of electricity. Essentially, the CGPA is a form of financial hedge that decouples the physical flow of electricity from the financial flow as illustrated below.

Power flow and financial transaction under the CGPA

(Source: Information Guide for Corporate Green Power Programme (For Solar PV Plant))

- Notably, the CGPA does not alter the solar developer’s and corporate consumer’s retail/supply relationship with the Electricity Utility Company (i.e., Tenaga Nasional Berhad).

- The solar developer will export the electricity generated to the power grid under the New Enhanced Dispatch Arrangement (“NEDA“) framework and at the System Marginal Price, i.e., the energy price of the most expensive thermal generator dispatched to meet demand in the particular half-hour period (“SMP“).

- On the other hand, the corporate consumer will procure electricity from the power grid at its location (“home market“) at the approved tariff rate.

- The CGPA is, essentially a contract for difference under which the parties agree on a settlement price mechanism for the energy supplied and consumed, which can either be a fixed price or a more complicated structure (“CGPA Price“).

- If the tariff rate paid by the corporate consumer for the energy consumed is higher than the CGPA price, the corporate consumer will pay the positive difference to the solar developer.

- Conversely, if the SMP received by the solar developer for the energy supplied is higher than the CGPA price, the corporate consumer will receive a payment of the difference.

- Typically in most cases, the payment of such differences will offset the increase or decrease in prices in the corporate consumer’s home market. However in Malaysia, given that the merchant market may not be similar to what is experienced in other jurisdictions in that the SMP is set by the Electricity Utility Company (i.e., Tenaga Nasional Berhad), corporate consumers are advised to engage market experts to ensure that the agreed CGPA Price provides sufficient buffer so as to place the corporate consumers in a favorable financial position.

Benefits of participating in the CGPP

- Corporate consumers will be able to procure renewable energy under the CGPP without having to install or be located near a solar panel or solar energy storage system since there is no physical transfer of electricity.

- Corporate consumers are entitled to the renewable energy certificates for the energy generated by the solar developers under the CGPA. This is especially relevant to corporate consumers interested in:

- Promoting the usage of renewable energy and sustainable business operations

- Fulfilling their environmental, social and governance (ESG) goals

- Offsetting their carbon emission and enhancing corporate reputation

- Corporate consumers will continue to have access to a stable supply of electricity without being affected by the solar developer’s supply capabilities.

- Depending on the agreed CGPA Price, the CGPA can guarantee a stable long term energy price for the amount of electricity contracted irrespective of the fluctuations of the wholesale electricity or market prices.

Eligibility Criteria

To be eligible for the CGPP, corporate consumers need to fulfill the following criteria:

- A corporate consumer must be a company operating in the manufacturing or service industry in Peninsular Malaysia, or plans to establish and operate in the said industries within the next two years.

- An existing corporate consumer must have credible financial position for the last three years.

- A new corporate consumer is required to have proven documents from the authority (i.e., Ministry of International Trade and Industry) and a projected annual revenue of not less than RM 10 million.

- The energy demand of the corporate consumer shall be no less than 1 MW.

- The corporate consumer shall remain a consumer of the Electricity Utility Company (i.e., Tenaga Nasional Berhad).

Key considerations and opportunities

Only solar developers who have secured a VPPA with corporate consumers may apply for the CGPP. Hence, corporate consumers interested in participating in the CGPP are required to seek out existing or potential solar developers who are interested in participating in the CGPP.

It is noteworthy that only companies operating in the manufacturing and service industry are eligible for the CGPP. While these would cover a majority of major businesses, there is no clear definition as to what would fall within manufacturing and service industry. As such, some industries may not be eligible to participate in the CGPP.

Apart from becoming an ‘off-taker’ in the CGPP, corporate companies with excess land in Peninsular Malaysia may consider collaborating with solar developers to jointly develop the solar energy project. Alternatively, corporate consumers may also consider leasing their lands to solar developers who are interested participating in the CGPP, as a separate stream of income.

With ESG considerations being the major driver of business operations and the potential implementation of carbon tax regimes, the CGPP provides a good opportunity for corporate companies operating in Malaysia to advance their renewable energy deployment efforts. Eligible companies should consider the potential opportunities above to maximise the environmental and commercial benefits of the CGPP.

* * * * *

This client alert was issued by Wong & Partners, a member firm of Baker McKenzie International, a global law firm with member law firms around the world. In accordance with the common terminology used in professional service organizations, reference to a “partner” means a person who is a partner or equivalent in such a law firm. Similarly, reference to an “office” means an office of any such law firm. This may qualify as “Attorney Advertising” requiring notice in some jurisdictions. Prior results do not guarantee a similar outcome.