Upcoming Webinar | 01 March 2023 8:00 AM – 02 March 2023 10:30 AM Arab Standard Time

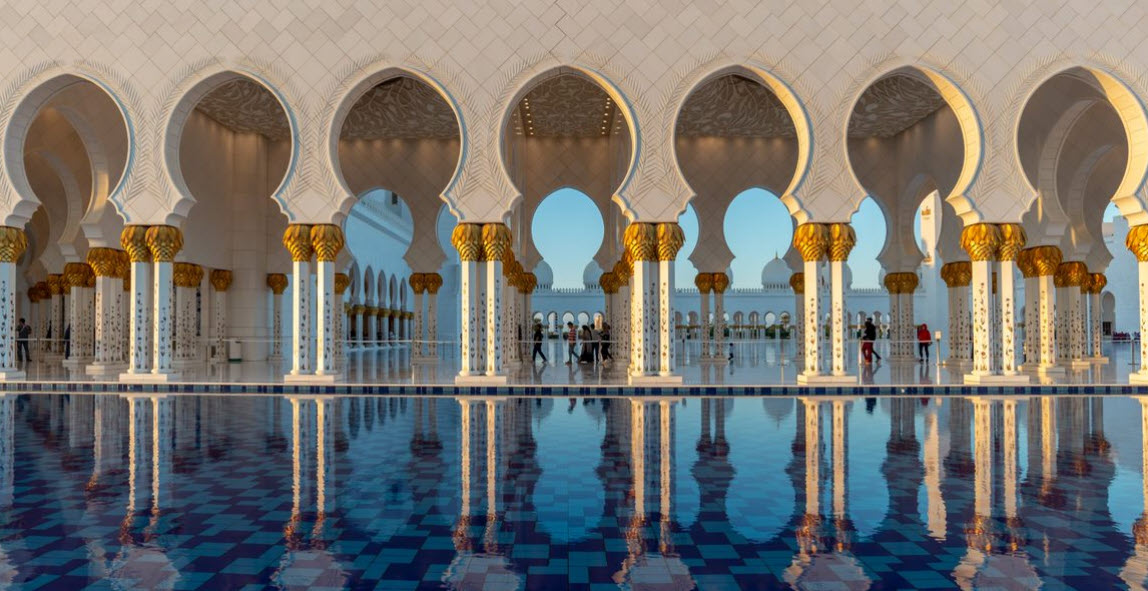

Baker McKenzie is delighted to invite you to interactive seminars on 1 March 2023 in Abu Dhabi and 2 March 2023 in Dubai as part of our EMEA Russia Sanctions Briefings.

The seminars will focus on the multijurisdictional sanctions challenges facing financial institutions and their clients and other corporates in the Gulf, in relation to the US, UK, EU and UAE sanctions regimes, particularly against Russia. We will also focus on the current enforcement environment and best practices for mitigating sanctions risk arising from potential compliance failures.

As part of the discussion, our international and Middle East sanctions and investigations experts will discuss the following themes from a US, UK, EU and UAE perspective:

- Update on current US, UK and EU sanctions as well as the UAE’s targeted financial sanctions regime

- Extraterritorial jurisdiction

- Key sanctions risks and compliance obligations for financial institutions and corporates in the Gulf

- Enforcement trends and engagement with sanctions regulators on key issues

Please register your interest using the RSVP buttons by 22 February 2023 as spaces are limited and mark your calendars. If you have any queries regarding the seminars, contact Jenny Medina.

One-to-one meetings

Our lawyers will be available for one-to-one meetings in the week of 27 February to 3 March 2023 to discuss specific sanctions-related issues you may have. Please contact us if you wish to set up a personal appointment as the number of meetings will be limited.

Visit our blog for global sanctions news and updates.

About this event

Date: 1 March 2023 (Abu Dhabi)

Agenda

8:30 am – Breakfast and networking

9:00 am – Seminar

10:45 am – Close

Location

Baker McKenzie

Level 8, Al Sila Tower

Abu Dhabi Global Market Square

Date: 2 March 2023 (Dubai)

Agenda

8:30 am – Breakfast and networking

9:00 am – Seminar

10:45 am – Close

Location

Four Seasons Hotel DIFC

Monogram Meeting Room

Gate Village, Building 9 DIFC, Dubai