In brief

On 13 April2023, the Canadian Securities Administrators (CSA) published a request for comments due by 12 July 2023, which can be found here. The CSA proposes two approaches (“Proposals“) to enhance the disclosure requirements of non-venture issuers that were previously adopted by most CSA jurisdictions in 2014 (“2014 Requirements“) regarding corporate governance practices pertaining to board nomination, board renewal and diversity on boards and in executive officer positions.

The Proposals are designed to increase transparency about diversity and to provide investors with useful information to better understand how diversity is addressed by an issuer. The CSA has also requested comments on adapting similar diversity disclosure requirements to venture issuers in the future.

Contents

In depth

Two approaches

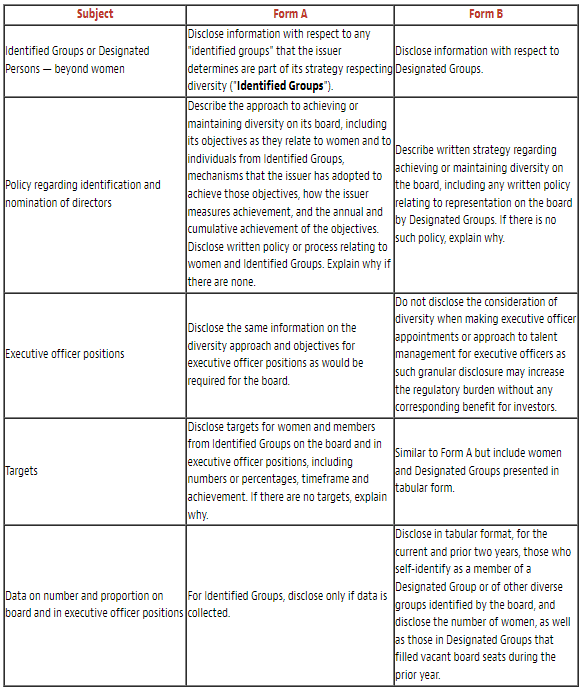

While substantially retaining the current disclosure on representation of women required in the 2014 Requirements, the CSA proposes two options to enhance diversity disclosure:

1) Flexible reporting (Form A) — Form A does not require disclosure of any specific group other than women. It gives the issuer the flexibility to determine what aspects of diversity are most beneficial to advance its business and strategy, to design its diversity practices and policies, and to determine how to disclose collected data.

2) Mandatory reporting (Form B) — Form B requires disclosure in a standardized tabular format on historically underrepresented groups beyond women: Indigenous peoples; racialized persons; persons with disabilities; and LGBTQ2SI+ persons (“Designated Groups“). Women and the persons identified in the Designated Groups, other than LGBTQ2SI+ persons, are the same as those persons for whom the Canada Business Corporations Act currently prescribes diversity disclosure. Form B is supported by the Ontario Securities Commission, while the other Canadian securities regulatory authorities support Form A or have not expressed a preference.

Examples of diversity disclosure requirements

The following is a brief summary of some elements of the Proposals that go beyond the 2014 Requirements:

Board nominations and board renewal

The Proposals also require, among others: more details regarding how the board identifies and evaluates new candidates for board nomination and how the board addresses board renewal; and whether there is a written policy about the nomination process and, if not, how the board carries out the process. Form B asks whether the written policy also addresses the nomination of persons from Designated Groups.

Implications

Issuers must seriously consider the issue of diversity beyond women and formally review their diversity practices and policies. We note the view of Glass Lewis that shareholders are best served when boards try to ensure that directors are reasonably diverse on the basis of factors that include race and gender. For 2024 and for companies in the S&P/TSX Composite Index, ISS generally recommends — subject to certain exceptions — voting against or voting withhold for the chair of the committee responsible for nominating directors (or chair of the board where there is no committee) if the board has no apparent racially or ethnically diverse members. Such members are Aboriginal peoples and members of visible minorities. Though still a “comply or explain” approach and not prescriptive, implementing one of options in the Proposals, along with other recent developments emphasizing the importance of diversity, will impact the evolution of non-venture issuers’ diversity practices and increase diverse representation on boards and in executive officer positions, as arguably has been the case with the 2014 Requirements — albeit slowly.