In brief

On 16 May 2023, the China Securities Regulatory Commission (CSRC) published Guideline No. 6 on the Application of Regulatory Rules on Overseas Securities Offerings and Listings: Guidelines for Overseas Offering of Global Depositary Receipts (GDR) by Domestic Listed Companies (“GDR Guideline”). It provides detailed guidance from the CSRC on the registration, filing, use of proceeds and other requirements on overseas offerings of GDRs by Chinese listed companies.

Contents

Background

On 17 February 2023, the CSRC published a new set of regulations consisting of the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies and five supporting guidelines (“New PRC Regulations”), which took effect from 31 March 2023. The New PRC Regulations mark a new filing regime that requires Chinese companies to register their direct and indirect overseas listings and securities offerings with the CSRC by filing relevant materials. The GDR Guideline published by the CSRC on 16 May 2023 is the sixth supporting guideline, which provides detailed guidance on the registration, filing, use of proceeds and other requirements on overseas offerings of GDRs by Chinese listed companies.

Overview of the GDR Guideline

(1) Requirements for registration and filing

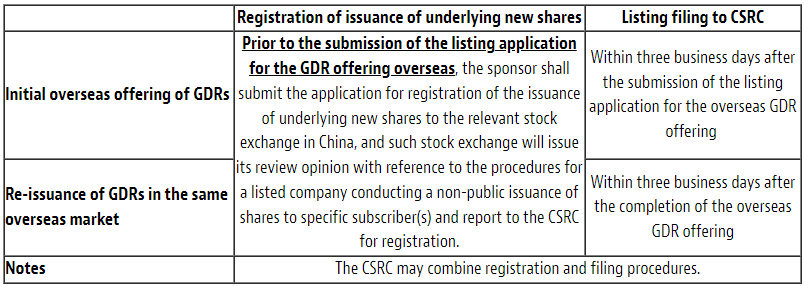

In terms of the application procedures, the GDR Guideline clarifies and refines the requirements for registration and filing:

The Chinese stock exchange review procedure, as mentioned in the table above, is a new requirement under the GDR Guideline. According to the provisions in the GDR Guideline, an application for registration of underlying new shares should be submitted to the relevant Chinese stock exchange prior to the submission of the listing application for an overseas GDR offering, but before completion of the registration with the CSRC. The registration of the issuance of underlying new shares by Chinese listed companies and the GDR listing filing procedures may be combined by the CSRC. Based on the latest market examples under the full registration regime, it usually takes around four to six months for a non-public offering of an A-share listed company to complete the CSRC registration process after the relevant documents are accepted by the Chinese stock exchange.

(2) Use of GDR proceeds

The GDR Guideline sets out new requirements for use of proceeds from the GDR offering. It requires the use of GDR proceeds to comply with the requirements of the national industrial policies and meet the overseas plans and business development needs of Chinese listed companies. There were no such specific requirements previously.

In addition, the GDR Guideline requires Chinese listed companies to raise funds rationally, determine the offering scale reasonably, and regulate themselves in accordance with Supervision Guide No. 2 on Listed Companies – Regulation on the Management and Use of Proceeds from Fund Raising by Listed Companies and other regulations. As such, the use of proceeds from a GDR offering is expected to be more strictly regulated than before, comparable to the use of proceeds from domestic share listings. For example, a listed company should use its IPO proceeds on its principal business activities. The use of proceeds by companies listed on the Shanghai Stock Exchange Science and Technology Innovation (STAR) Board should be in line with national industrial policy and relevant laws and regulations, and should be invested in the industry of science and technology innovation. Unallocated proceeds may be temporarily used as the listed company’s working capital provided that (a) it will be used for production and the operation of the company’s principal business, and (b) the maximum period of such use of proceeds shall not exceed 12 months.

(3) Documents preparation

The GDR Guideline also contains further documentary requirements, such as filing application materials, decision-making procedure documents, prospectus and issuance report. In particular, for underlying new shares, the prospectus should be prepared and disclosed in accordance with the Guidelines on the Content and Format of Information Disclosure by Companies Offering Securities to the Public No. 61 – Prospectus and Report on Issuance of Securities by Listed Companies to Target Subscribers (“Guideline No. 61“), and the listed companies should disclose risks including the impact on the price of A-shares resulting from the conversion of GDRs into underlying new A-shares after expiration of the conversion restriction period. This means that the prospectus must cover all the contents required by Guideline No. 61 and be adjusted in accordance with the format and style of Guideline No. 61 when it is submitted to the Chinese stock exchange for review.

(4) Alignment with A-share non-public share issuance requirements

The GDR Guideline has further aligned the requirements on GDR offerings with the A-share non-public share issuance rules. For example, it provides that the decision-making process, information disclosure and other matters of GDR offerings should comply with the relevant rules for a Chinese listed company’s non-public share issuance to specific subscriber(s). Accordingly, the board of directors and shareholders in general meetings of Chinese listed companies should consider and approve matters on the issuance plan, demonstration and analysis report, feasibility report on the use of proceeds, etc. Chinese listed companies are also required to fully explain whether the offering is in line with the GDR positioning characteristics. As a result, the preparation of the feasibility report on the use of proceeds will also become relatively time-consuming.

(5) Moratorium

The GDR Guideline specifies that the offering interval should be determined with reference to Article 16 of the Measures on Administration of the Issuance and Registration of Securities by Listed Companies and the fourth point of the Opinions on the Application of Securities and Futures Laws No. 18 on share issuance to a specific subscriber. According to Article 16, the date of the board resolution on a secondary offering by listed companies must, in principle, be no less than 18 months from the date of receipt of the proceeds from the last offering. If the proceeds from the last offering are used up, or if there is no change in the investment plan and the proceeds from the last offering are invested as planned, the corresponding offering interval must, in principle, be no less than six months.

(6) Transitional period

For ongoing GDR projects, the GDR Guideline clarifies the transitional arrangements using 31 March 2023 as the benchmark date:

- Chinese listed companies that submitted applications for overseas GDR offerings but had not received the CSRC approval before 31 March 2023, are required to fulfil the registration procedure for the issuance of underlying new shares and the filing procedure for the overseas offerings and listings.

- Chinese listed companies that had obtained shareholders’ approval before 31 March 2023 for their proposed overseas GDR offerings are not required to obtain shareholders’ approvals again.

For further information and to discuss what this development might mean for you, please get in touch with our lawyers set out under “Contact Us” or your usual Baker McKenzie contact.