Simplified retail establishment process for CPTPP investors

In brief

From 15 January 2024 foreign investors from Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) members seeking to establish retail outlets will no longer be required to comply with the Economic Need Test (ENT). This will provide an important competitive advantage for CPTPP member investors operating in Vietnam.

The CPTPP is the first free trade agreement to offer this landmark liberalization to foreign investors to Vietnam and will allow foreign brands to expand their retail presence in Vietnam’s fast growing retail sector, which the Ministry of Industry (MOIT) expects to hit 350 billion USD by 2025.1

The ENT

Presently, foreign investors establishing retail locations in Vietnam need to comply with the cumbersome Economic Needs Test (ENT) to set-up new retail locations. ENT applies to retail locations beyond the first, which are 500m2 or larger in size and are not located in a shopping mall, nor classified as a convenience store or mini supermarket.2 The ENTs main criteria assesses the geographic area of the proposed retail location, number of existing service suppliers, the stability of the market, and the geographic scale.3 Thus the ENT assessment process often results in the delayed establishment of new retail locations, or results in foreign investors abandoning market expansion entirely.

Fortunately, the CPTPP provides for a removal of the ENT for investors from CPTPP member states, taking effect five years from the entry into force of the CPTPP for Vietnam4 (“ENT Removal“). Furthermore, the Ministry of Industry and Trade (MOIT) has further recognized the CPTPP ENT Removal, by acknowledging Vietnam’s CPTPP commitment to remove restrictions on expanding the number of retail locations.”5 Thus, based upon the above, from 15 January 2024, CPTPP member investors will no longer be subject to the ENT requirement currently imposed on foreign investors.

A similar ENT Removal is provided in both the European Union – Vietnam Free Trade Agreement (EVFTA) and the United Kingdom – Vietnam Free Trade Agreement (UKVFTA), also taking effect 5 years after entry into force. The EVFTA entered into force on 1 August 2020, thus, EU investors will be entitled to an ENT removal from 1 August 2025.

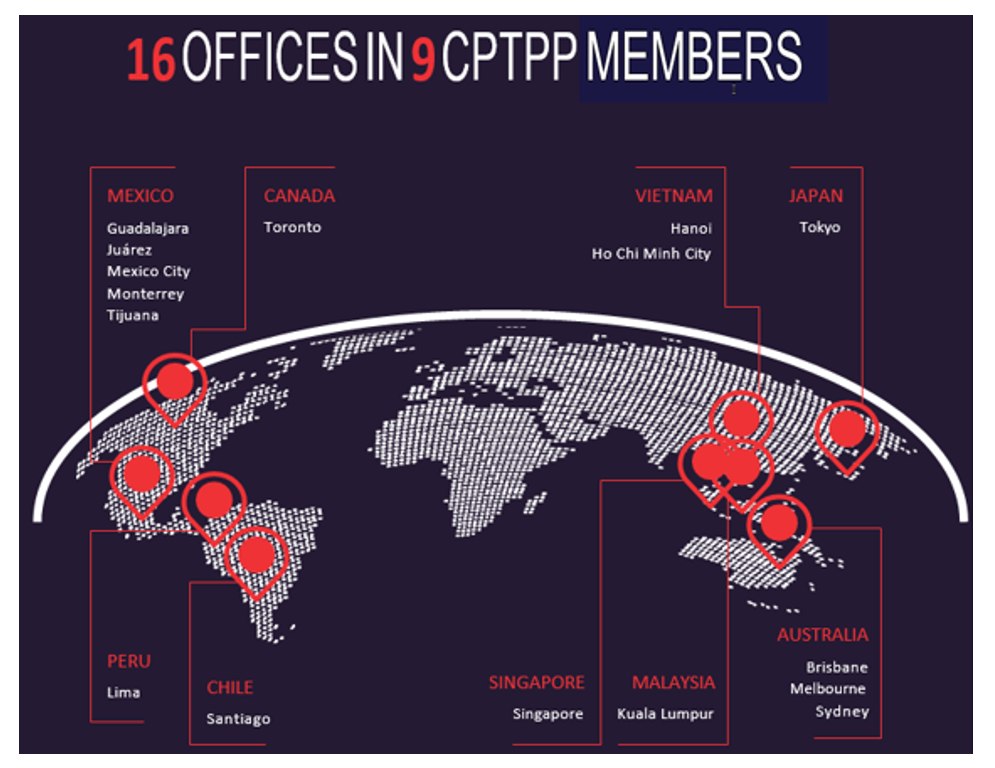

CPTPP membership

The CPTPP ENT Removal will be enjoyed by foreign investors to Vietnam from CPTPP members. The CPTPP has eleven members, namely: Australia, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, Vietnam, and Brunei, the latter being the most recent to ratify the CPTPP in May of 2023.

Since the CPTPP entered into force, it has received five applications for accession from the UK, China, Taiwan, Ecuador, and Costa Rica. Only the UK has completed negotiations to join and is expected to formally accede in 2023.

The CPTPP is one of the world’s largest trade pacts, with 11 members accounting for approximately 13% of global GDP.6 The CPTPP goes well beyond the parameters of the traditional WTO rules-based trading system by expanding its scope to include investment, competition, e-commerce, regulatory coherence, labor, the environment and investor-state dispute settlement.

* * * * *

If you would like more information on establishing a retail network in Vietnam, or taking advantage of the CPTPP, please do not hesitate to contact us.

1 https://mof.gov.vn/webcenter/portal/vclvcstc/pages_r/l/chi-tiet-tin?dDocName=MOFUCM264421

2 Decree No. 09, Art. 23.

3 CPTPP Annex I, P. 6.

4 CPTPP Annex I, P. 6.

5 CPTPP: Viet Nam’s commitments in some key areas, p.13, available at: http://cptpp.moit.gov.vn/data/e0593b3b-82bf-4956-9721-88e51bd099e6/userfiles/files/2_%20CPTPP%20Viet%20Nam%E2%80%99s%20commitments%20in%20some%20key%20areas%20-%20EN%20(3).pdf

6 New Zealand Foreign Affairs and Trade, https://www.mfat.govt.nz/en/trade/free-trade-agreements/free-trade-agreements-in-force/cptpp/cptpp-overview/