In brief

On 31 July 2023, the Monetary Authority of Singapore (MAS) published a Consultation Paper setting out a proposed regulatory framework for Single Family Offices (SFOs) in Singapore. The new measures under this proposed framework allows MAS to enhance its surveillance and defence against money laundering risks within the SFO sector.

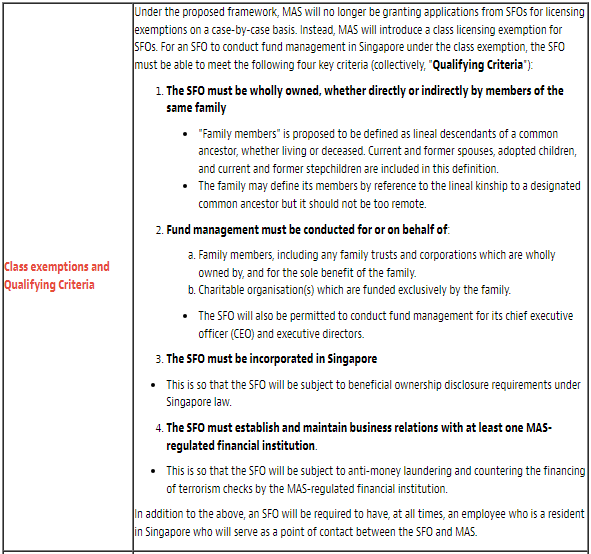

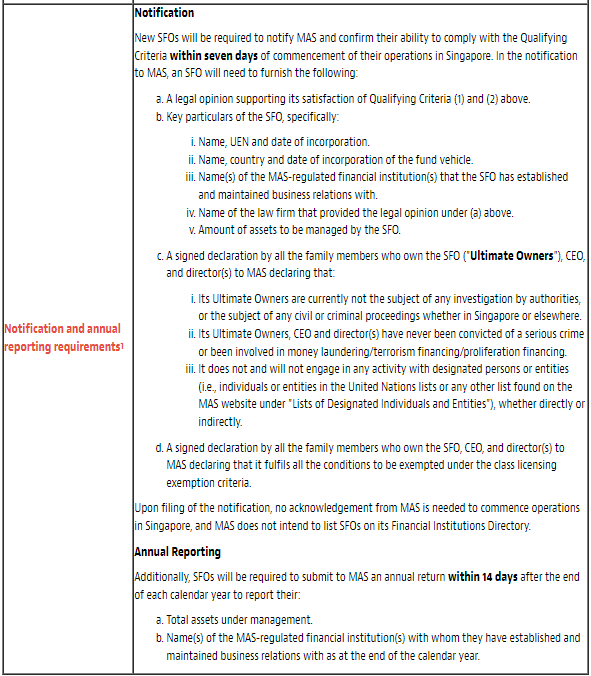

The proposed SFO framework introduces a harmonised set of qualifying criteria that SFOs must fulfil in order to be exempted from licensing requirements under the Securities and Futures Act 2001 (SFA) to conduct fund management in Singapore. In addition, SFOs will be required to comply with new notification and annual reporting requirements.

Key proposed measures under the framework

We summarise the key measures under the proposed SFO framework in the table below.

Proposed transitional arrangements

MAS proposes a transitional period of six months from the effective date of the proposed SFO framework for all SFOs with existing licensing exemptions to confirm their ability to comply with the new Qualifying Criteria and notify MAS of the same2.

The existing licensing exemption that an SFO has been relying on prior to the implementation of the new SFO framework would either be withdrawn upon the SFO’s filing of the requisite notification to MAS, or, at the end of the transitional 6-month period, whichever is earlier. SFOs that have filed the notification with MAS are allowed to continue operating in Singapore without the need to obtain MAS’ acknowledgement. SFOs that are unable to meet the Qualifying Criteria (and are thus unable to file the notification), and continue to carry on business in fund management after the transitional 6-month period will be considered to be in breach of the SFA.

The MAS seeks comments on this consultation paper by 30 September 2023, 11.59 PM.

If you have any feedback or questions, please do not hesitate to contact us.

1 MAS will be providing further details on the mode of submission for the proposed notification and annual returns for SFOs at a later stage and prior to the implementation of the new SFO framework.

2 Note that where an SFO had applied for tax incentive under Section 13O or Section 13U of the Income Tax Act and furnished a legal opinion to MAS as part of its application, the SFO will also be required to obtain a new legal opinion that the SFO meets the Qualifying Criteria.

* * * * *

© 2023 Baker & McKenzie.Wong & Leow. All rights reserved. Baker & McKenzie.Wong & Leow is incorporated with limited liability and is a member firm of Baker & McKenzie International, a global law firm with member law firms around the world. In accordance with the common terminology used in professional service organizations, reference to a “principal” means a person who is a partner, or equivalent, in such a law firm. Similarly, reference to an “office” means an office of any such law firm. This may qualify as “Attorney Advertising” requiring notice in some jurisdictions. Prior results do not guarantee a similar outcome.