In brief

The Securities and Exchange Commission of Thailand (SEC) has amended and issued regulations1 (17 in total) to provide clarity regarding the nature of businesses that may be considered investment companies. The amended regulations also impose disclosure obligations, where an investment company is also a listed company, and prohibit any investment companies from offering securities, except in limited circumstances. These regulations became effective on 1 January 2024.

In more detail

Key amendments

A. Clarification of nature of businesses that may be deemed to be investment companies

Any listed company with passive investments in securities, derivatives, or digital assets, in aggregate exceeding 40% of its total assets based on the latest financial statement or the latest consolidated financial statement is, by virtue of the amended regulations, an “investment company” and is subject to additional disclosure obligations and securities offering restrictions. Its shares may also be subject to trading restrictions per the details below.

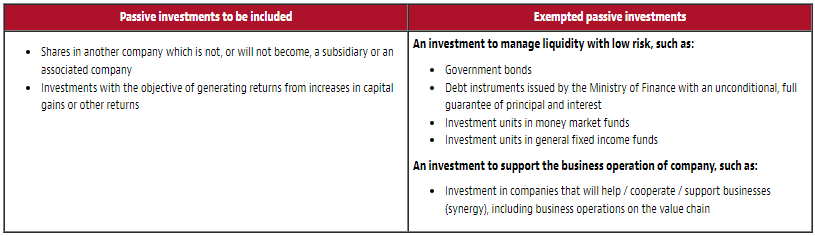

The following table gives examples of passive investments, to be calculated as part of the 40% threshold, and types of investments that qualify as exempted investments and therefore are not counted as part of the 40% threshold.

B. Disclosure obligation of an investment company

A listed company that is deemed to be an investment company must include additional information in the notes to its financial statements. The additional information includes, among other things, investment proportions, realized gains or losses, and unrealized gains or losses. The company must disclose this information in each quarterly report until such period as the investment proportion constitutes less than 40% of the company’s total assets. The reporting obligation applies to financial statements for any period that ends on or after 31 March 2024.

C. Prohibition of offering of securities by an investment company

Securities of a listed company that is deemed to be an investment company may be assigned either a C classification (Caution) or an SP classification (Trading Suspension) by the Stock Exchange of Thailand (SET), suspending trading of the listed securities2, unless the investment company is exempted3. If such a classification is made by the SET, this will prohibit the affected listed companies from offering all types of securities under the securities law, including shares, debentures, or transferable subscription rights, irrespective of whether the offering is made to the public or a private placement4.

Call for action

In addition to operating genuine businesses, it is vital for every company to make an investment with caution, especially an investment in securities, derivatives or digital assets, which can collectively bring about investment company status. The company should provide a clear investment plan and keep track of its past investments, with effective internal control, to avoid the potential of being classified as an investment company. Also, the SET regulation will further clarify measures for assigning classifications and a deadline for a listed company to rectify its status as an investment company, prior to delisting. Listed companies are encouraged to follow this development closely.

1 Including (i) Notification of the Capital Market Supervisory Board No. TorJor. 45/2566 Re: Application for Approval and Granting of Approval for Offering of Newly Issued Shares (Volume 16), (ii) Notification of the Capital Market Supervisory Board No. TorJor. 48/2566 Re: Rules, Conditions and Procedures for Disclosure regarding Financial and Non-financial Information of Securities Issuers (Volume 26), (iii) Notification of the Capital Market Supervisory Board No. TorJor. 50/2566 Re: Approval for the listed companies to issue the Newly Issued shares to the specific investors (Volume 2), (iv) Notification of the Capital Market Supervisory Board No. TorJor. 51/2566 Re: Application for and Approval of Offer for Sale of Newly Issued Share Warrants and Underlying Shares (Volume 10), (v) Notification of the Capital Market Supervisory Board No. TorJor. 53/2566 Re: Application and Approval for Offering of Newly Issued Debt Instrument in public offering (Volume 4), (vi) Notification of the Capital Market Supervisory Board No. TorJor. 54/2566 Re: Application and Approval of the Offering for Sale of Newly Issued Debt Instruments to a Private Placement and Offering of Convertible Debentures to Qualified Person (Volume 4), (vii) Notification of the Capital Market Supervisory Board No. TorJor. 57/2566 Re: Offer for Sale of Newly issued Securities to Directors or Employees (Volume 5), (viii) Notification of the Office of the Securities and Exchange Commission No. SorJor. 33/2566 Re: Consideration of company size in relation to approving companies that conduct business by holding shares in other companies (holding company) to offer newly issued shares, (ix) Table of consideration of company size in relation to approving holding company to offer newly issued shares, and (x) Guideline Statement No. NorPor. 5/2566 Re: Guidelines for considering investment of companies having characteristic of an investment company.

2 The SET regulation is not yet published. The hearing process ended on 5 January 2024.

3 Grounds for exemption include an offer of securities made in accordance with a business rehabilitation plan, itself undertaken in compliance with bankruptcy law and court-approved. Grounds for exemption will vary depending on types of securities.

4 Rights offerings to existing shareholders are not subject to the offering regulation under the Securities and Exchange Act B.E. 2535 (as amended).