In brief

The Bank of Thailand (BOT) intends to strengthen the role of financial service providers in taking responsibility for consumers throughout the loan debt cycle appropriately and comprehensively. The BOT Notification No. Sor Gor Chor. 7/2566 re: Responsible Lending was issued by the BOT and announced in the Government Gazette on 27 December 2023, and became effective on 1 January 2024 (“Notification“).

The Notification applies to various service providers, including the following:

- Financial institutions and companies within its financial business group

- Asset management companies

- Credit card business operators

- Personal loan business operators under supervision

- Nano-finance business operators under supervision

These entities are collectively referred to as “Service Providers“1.

In more detail

Background

The Notification requires the Service Providers to offer lending products responsibly and ethically throughout the debt cycle and enhances compliance with the existing guidelines and regulations to be more comprehensive and clearer. Financial service providers must comply with this Notification in addition to the existing BOT regulations, such as the Market Conduct Regulations.

The Notification specifies requirements from before customers create new debt, requirements in relation to handling and operating existing debt with quality and care, requirements on handling bad debt, up until litigation and transfer of debt sales. This includes promoting the provision of information to influence customer behavior throughout the debt cycle. This is in order to promote good credit culture and financial discipline to customers, which will be an important part in solving the household debt problem sustainably.

Debt cycle:

Overview of the regulations

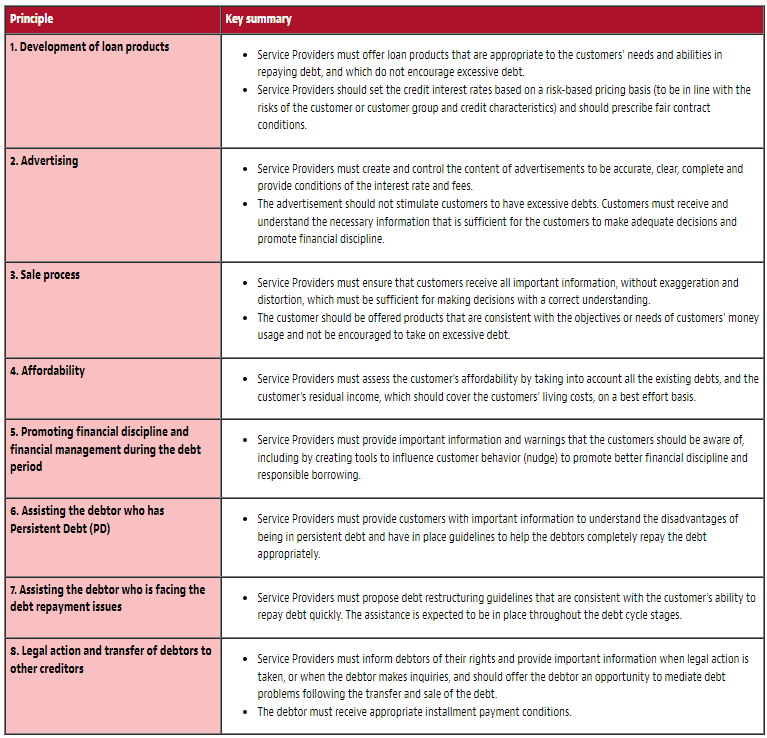

The Notification sets out the eight principles that the Service Providers must comply with throughout the loan debt cycle, as illustrated below. The attachments to this Notification also provide a list of “Do’s” and “Don’ts”, examples, and guidelines for the Service Providers under each principle.

Scope of applicability

The applicability of the principles and guidelines under this Notification varies depending on the type of loan products that are being offered. Please see the table below.

The Service Providers offering lending products must implement the guidelines under the Notification to its loan products in addition to the other on-going regulations, such as the BOT’s market conduct regulations and the BOT notification regarding interests, fees, and fines.

There are further details to the requirements mentioned above, including the timeline to comply with certain requirements (e.g., Persistent Debt).

For more information, please feel free to contact our team at Baker McKenzie.

1 The “Service Providers” under this Notification refers to the offeror, recommender, seller, factor, and transferee of a lending product.