In brief

Following a new regulation of the Securities and Exchange Commission of Thailand (SEC) defining new characteristics of bills (i.e., bills of exchange and promissory notes) that are considered securities, the Capital Market Supervisory Board of Thailand (CMSB) has amended the requirements for offerings of bills to match the new definition. The new offering requirements will come into effect on 16 March 2024.

Contents

In more detail

Background

Bills (i.e., bills of exchange and promissory notes) are debt instruments that are typically used for raising funds in Thailand. Due to the ease of transferability, certain types of bills are considered securities under Thai securities law; hence, offerings of bills are subject to approval and filing requirements. Also, due to the ease of making or issuing — individuals and corporates may issue or make bills — corporate issuers are sometimes caught off-guard for failing to comply with the approval and filing requirements. Individuals making bills are not subject to the requirements. As a result, determining whether bills are considered securities is critical for corporates.

New definition

The new SEC regulation defines bills considered securities as bills of exchange and promissory notes, which are (1) issued or made by a corporate as evidence of rights under the bills (i.e., evidence of debts), (2) accompanied by solicitation or advertisement of the issuance of the bills for the purpose of raising funds from more than 10 persons, and (3) still outstanding. The regulation provides exemptions for (1) any bill which the Ministry of Finance of Thailand guarantees in full and (2) any bill issued by the Bank of Thailand.

Additional exemptions in the circular letter

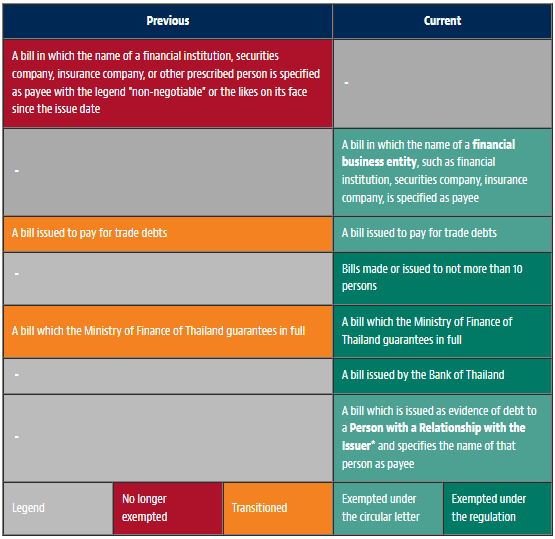

Despite the absence of definitions for bills that were previously not considered securities, such as a bill issued to pay trade debts or a bill issued to financial institutions with the legend “non-negotiable” or the likes on its face, the Office of the SEC has issued a circular letter to clarify that certain characteristics of bills may not be considered securities. The following table shows characteristics of bills that were not securities under the previous regulation (before the new definition came into effect) and bills that the SEC may not treat as securities under the current regime.

*”Person with a Relationship with the Issuer” refers to a director, executive, employee, major shareholder, subsidiary or associated company of the issuer, including persons who have ceased to have a relationship of any of the aforementioned types for no more than three months, as defined in the Notification of the Securities and Exchange Commission No. KorChor. 39/2564 Re: Designation of definition of institutional investor, ultra-high-net-worth investor and high-net-worth investor.

Offering requirements

As the new SEC regulation effectively removes bills issued or made by a corporate which remain outstanding at any given time not exceeding 10 bills from the definition of bills that are considered securities, the CMSB has amended the offering regulation to remove a private placement exemption for an offering of up to 10 bills from the regulation. In the past, issuing even a single bill could subject a corporate to the offering requirements if none of the exemptions could apply. Other changes in the new regulation are clarifications of wording.

Call for action

While the new definition of bills considered securities, when read in conjunction with the circular letter, may appear more limited than the old definition, there is a caveat regarding the number of bills that a corporate may issue. The new regulations focus on the number of investors (up to 10) instead of the number of bills outstanding. In fact, the circular letter provides a quite extreme example that the SEC would consider an offering of securities if a corporate issues 160 bills to 8 persons, who subsequently transfer bills such that there are more than 10 investors. It is then quite easy to determine that the corporate has the intention to use bills as securities for raising funds from the capital markets. However, determining whether issuing 11 bills to 10 persons, and one of which subsequently transfers a bill to another person outside the group, may be much more difficult to analyze whether the issuer has any intention to circumvent the securities law. In another circular letter issued at the time the offering regulation was announced, the SEC emphasizes that an issuer is subject to the approval and/or filing requirements, even if the issuer is offering bills to less than 10 persons, provided it has the intention to raise funds from more than 10 persons. Hence, it is advisable for any corporate to limit the number of bills it issues to not more than 10 bills at any given time, regardless of whether the total number of investors reaches 10.