In brief

In a move to develop Thailand’s position as a regional hub of investment, the Office of the Securities and Exchange Commission (SEC) began a public hearing on the new securities and derivatives business licensing regime on 9 February 2024, designed to increase flexibility and decrease costs for business operators. The proposed changes are shown below.

In more detail

For applicants of new licenses

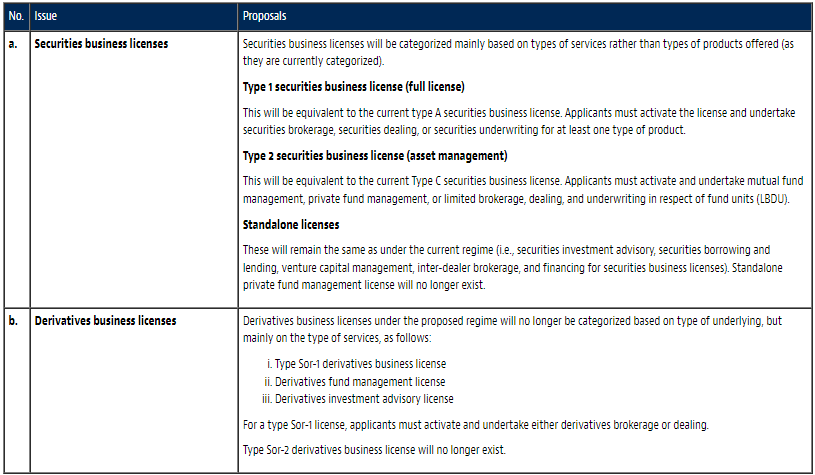

1. Types of licenses

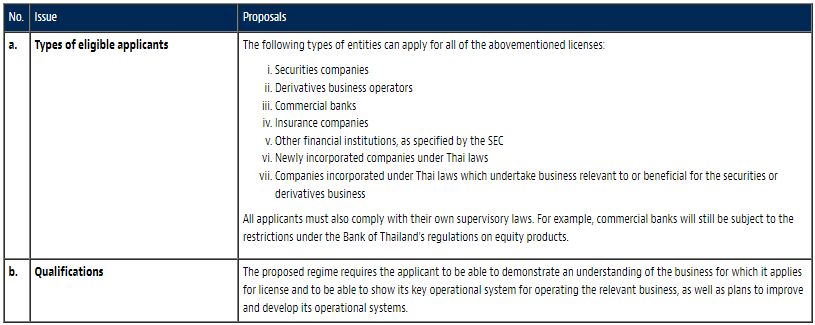

2. Qualifications for applicants

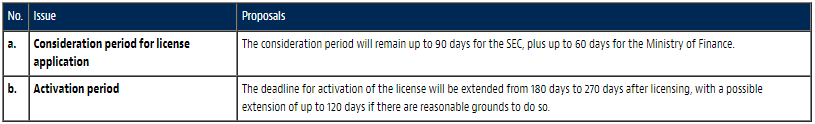

3. Timeline

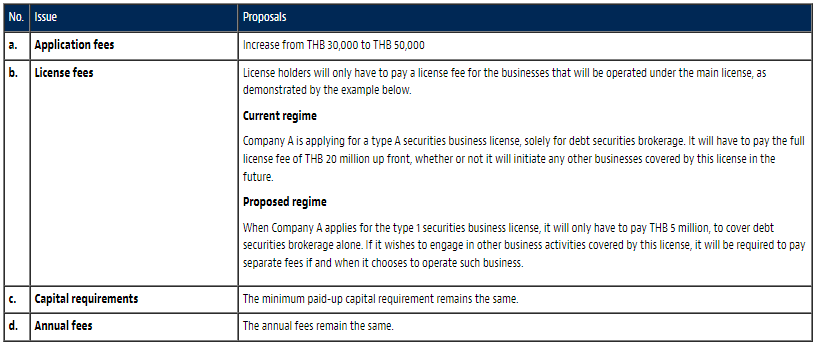

4. Costs

For existing license holders

1. Auto-migration

Existing license holders will be migrated to the new regime automatically, and while no new physical license will be issued, they will be deemed to hold these licenses, and no additional fees will be charged.

The migrated business operator will be able to conduct the business it is permitted to do under its current license. Based on the hearing, the SEC will update its SEC Check First database on its website so that investors are aware of the change of license, and can trace the type of business each business operator is allowed to conduct.

2. Activation of new business within new license

If a migrated business operator wishes to conduct business that is within the scope of its new license but outside the scope of its current activated license, it will have to go through an activation process and pay applicable fees.

What remains to be seen

A number of issues remain unresolved, such as:

- Whether business operators which have paid up-front license fees under the current regime but which have not activated all businesses under the license will be entitled to a refund.

- Whether other supervising regulators will relax the restrictions imposed on business operators under their supervisory powers given that the SEC allows such business operators to obtain securities and derivatives business license.

Moving forward

The hearing will continue until 11 March 2024, and the new set of regulations is expected to be issued and become effective within the first quarter of 2025. As the proposed reform will cause substantive changes to the current securities and derivatives business licensing regime, companies which are interested in obtaining new securities or derivatives business licenses, as well as existing license holders, are encouraged to keep an eye out for new developments in this area.

For more information, please contact our team at Baker McKenzie.