In brief

The Department of Climate Change and Environment (DCCE) under the Ministry of Natural Resources and Environment (MONRE) is pushing ahead with the second draft of the Climate Change Bill (“Bill“), which is currently undergoing the process of public hearing until mid-April 2024. It is expected that the Bill will be considered by the cabinet for approval in principle in June 2024.

The Bill lays out Thailand’s action plan for climate actions and, importantly, imposes obligations and penalties for the private sector for the purposes of advancing climate mitigation and adaptation efforts. Some of the key elements of the Bill are summarized in this article.

In depth

Overview

The Bill seeks to increase efforts to fulfil Thailand’s commitments under the Paris Agreement, which are to reduce greenhouse gas (GHG) emissions by 30% to 40% in 2030, move towards carbon neutrality by 2050 and net zero GHG emissions by 20651, respectively. It also aims to mitigate the impact of climate change, which is increasingly becoming more severe as global temperatures rise. The Bill provides for various mechanisms to achieve climate change mitigation targets through economic instruments, such as carbon credits, carbon tax and a domestic emissions trading system (ETS), as well as mandatory compliance measures for business operators. Through these measures and instruments, the Bill aims to increase Thailand’s capabilities to mitigate and adapt to climate change, enabling the transition to a more sustainable economy.

Some of the key elements of the Bill are:

GHG reporting for the development of Thailand’s GHG inventory

The Bill aims to establish a central database on Thailand’s GHG emissions, which will contain information on the release of GHG from human activities at the source, the amount of GHG removed or absorbed by nature and human activity, and the net GHG reduction amount.

Further ministerial regulations will be issued detailing the reporting requirements for the private sector. The information that may potentially be required to be reported include, among others, information on energy and transportation, industrial processes, agriculture, forestry and land use, and waste management.

Application of the carbon pricing mechanisms

Three economic instruments, the ETS, carbon tax and carbon credits, will be applied to accelerate GHG emissions reduction in all sectors.

- ETS: The Bill outlines details on the establishment of a domestic ETS. To provide a brief overview, the ETS is a mandatory system which sets the emissions limit, the so-called cap setting for each participant, and allows emissions allowance to be traded for the participants who have surplus allowances and the participants who pollute above the capped limit. A plan for allowance allocation will be developed, in line with the National Climate Change Master Plan and the National Greenhouse Gas Reduction Action Plan as established under the Bill. The allowance allocation plan will include details on the emissions allowance for each type of industrial sector, and the time period in which to surrender, cancel out, or borrow emissions allowance.

- Carbon Tax: A carbon tax will be imposed on certain products at one point in their life cycle. The purpose is to reduce the amount of GHG emissions within the country, as well as to prevent carbon leakage across borders. Details on the type of product taxed, the tax rate, procedures, principles, and conditions will be further specified by ministerial regulations. Persons that will be taxed under the Bill include importers, manufacturers, and industrial operators.

- Carbon Credits: Carbon credits are one of the economic mechanisms used as an incentive for reducing GHG emissions and are earned through the implementation of mitigation and removal projects. In line with the existing rules and regulations, the Bill requires that carbon credits arising out of GHG reduction projects located in Thailand be registered and certified by the Thailand Greenhouse Gas Management Organization (Public Organization), or TGO, to be traded in both domestic and international markets. Project developers are required to measure, report and verify the amount of GHGs arising out of the project.

Roles and obligations for business operators

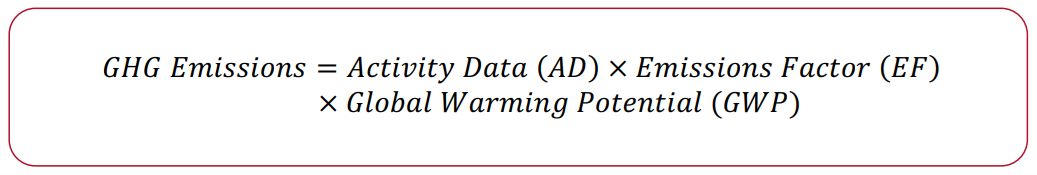

Under the Bill, business operators have an obligation to perform GHG data collection and reporting. Specific business operators, as defined under the aforementioned, must submit their activity data to the relevant government agency. In addition, controlled juristic persons specified by ministerial regulations for ETS must submit their GHG emissions report with verification by the registered verifier. Generally, GHG emissions are calculated by multiplying the activity data, emissions factor and global warming potential, as shown below.

With regards to the applicability of the economic instruments, controlled juristic persons as specified by ministerial regulations are required to participate in the ETS. In addition, a carbon tax will also be applied for certain products. To participate in the voluntary carbon credits scheme, business operators are required to comply with the rules and regulations on carbon credits under the Bill.

Lastly, private companies may apply for financing from the Climate Change Fund as established under the Bill. The purpose of this provision, among others, is to incentivize the creation of decarbonization technologies.

Under the Bill, fines are imposed on a range of misconduct, including the submission of falsified GHG emissions information.

It is important that businesses familiarize themselves with the roles and obligations under the Climate Change Bill, not only to ensure compliance but also to effectively implement sustainable practices and benefit from the measures and incentives provided under the law.

1 https://unfccc.int/sites/default/files/resource/Thailand_LTS1.pdf