In brief

On 7 March 2024, the Financial Institutions (Miscellaneous Amendments) Bill (“FIMA Bill“) was read for the second time in the Singapore Parliament. Broadly, the FIMA Bill seeks to reinforce the Monetary Authority of Singapore’s (MAS) mandate over Singapore’s financial sector through the following:

- Harmonising and enhancing MAS’ investigative powers across six Acts, namely the Financial Advisers Act 2001 (FAA), the Financial Services and Markets Act 2022, the Insurance Act 1966, the Payment Services Act 2019, the Securities and Futures Act 2001 (SFA) and the Trust Companies Act 2005 (TCA), (collectively, “MAS-Administered Acts“), where MAS will be granted broader authority to procure evidence and facilitate the transfer of evidence between it and other law enforcement agencies, among other things

- Augmenting MAS’ regulatory purview over financial institutions (FIs) operating specifically in the capital markets sector.

Key amendments

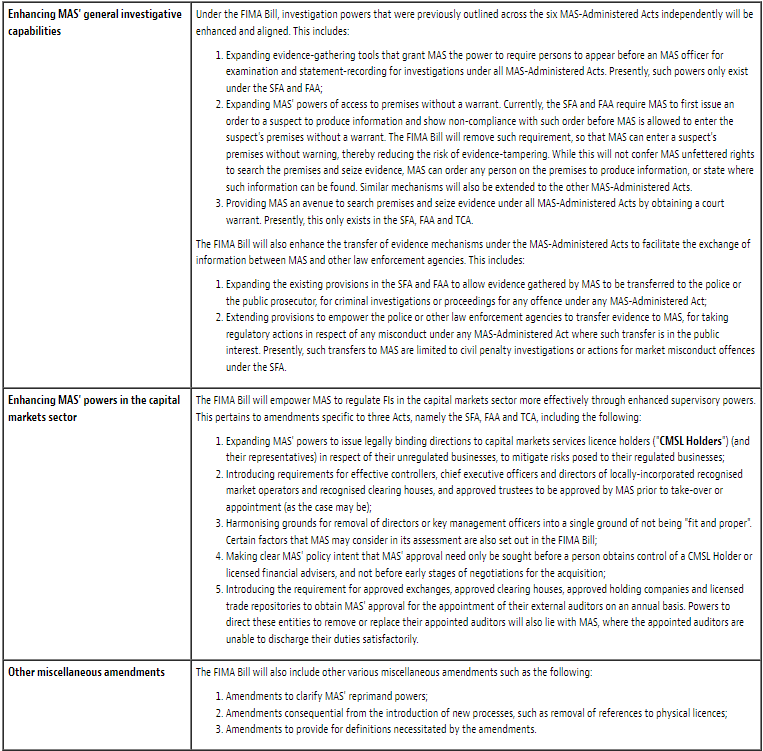

We summarise the key amendments under the FIMA Bill in the table below.

© 2024 Baker & McKenzie.Wong & Leow. All rights reserved. Baker & McKenzie.Wong & Leow is incorporated with limited liability and is a member firm of Baker & McKenzie International, a global law firm with member law firms around the world. In accordance with the common terminology used in professional service organizations, reference to a “principal” means a person who is a partner, or equivalent, in such a law firm. Similarly, reference to an “office” means an office of any such law firm. This may qualify as “Attorney Advertising” requiring notice in some jurisdictions. Prior results do not guarantee a similar outcome.